Large-caps in limelight on trade deal optimism

20-11-2025 12:00:00 AM

FPJ News Service mumbai

Large-cap equities outperformed the broader market on Wednesday, buoyed by renewed optimism over a prospective India–US trade agreement and positive commentary from the Union Commerce Minister Piyush Goyal on domestic economic fundamentals.

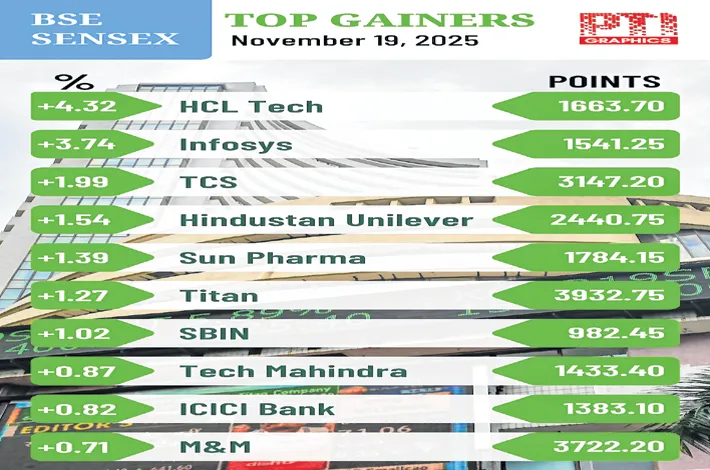

Technically speaking, improving macroeconomic fundamentals, policy reforms, infrastructure development, investment promotion, and bankruptcy resolution have benefitted from political stability. Continuing consistency in government policy will be key to some of the ongoing reforms. This does not appear to be an immediate risk, however, potential hurdles in industrial policy implementation, if any, could deter investor-sentiment. The BSE Sensex rose 513.45 points to close at 85,186.47, and the NSE Nifty ended 142.60 points higher at 26,052.65.

Vinod Nair, Head of Research at Geojit Investments, noted that benchmark indices “staged a strong rebound” following the minister’s remarks. He added that IT stocks advanced on revived expectations of a Federal Reserve rate cut, supported by soft US labour data and favourable currency movements, while PSU banks strengthened on merger-related developments.

Investors now look to Thursday’s FOMC minutes for further policy direction. According to Dr V. K. Vijayakumar, Chief Investment Strategist at Geojit Investments, an “anti-AI trade” is unfolding in global markets. He highlighted recent caution voiced by Google CEO Sundar Pichai and noted that the Nasdaq has fallen 1,526 points from its recent peak. While some investors remain optimistic, concerns over a potential AI-driven market bubble persist.

Dr Vijayakumar said the orderly correction in AI-related stocks may prove beneficial for India, as sustained weakness in the global AI trade could prompt renewed FPI inflows. India’s recent outperformance relative to AI-focused markets such as South Korea and Taiwan supports this view.