Inflation hits 8-yr low at 1.54%

14-10-2025 12:00:00 AM

Will RBI cut rates in December?

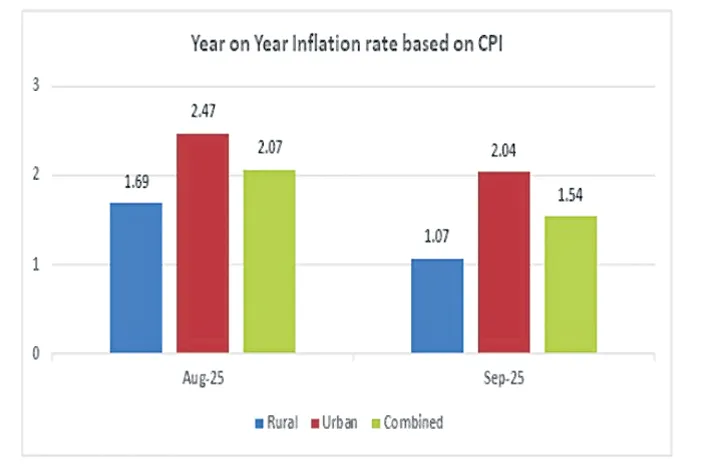

India’s annual headline inflation slowed to 1.54% in September 2025, recording an eight-year low, government data indicated on Monday, leaving room for the Reserve Bank to cut rates one more time.

Early October, the apex bank projected CPI inflation for 2025-26 at 2.6% with Q2 at 1.8%; Q3 at 1.8%; and Q4 at 4%. CPI inflation for Q1:2026-27 was projected at 4.5%.

On October 1, 2025, the MPC of the apex bank kept the policy rate unchanged at 5.5%, citing concerns over tariff woes. The RBI had said that the current macroeconomic conditions and the outlook opened up policy space for further supporting growth.

The MPC had noted that the impact of the front-loaded monetary policy actions and the recent fiscal measures was still playing out.

The trade related uncertainties were unfolding. The MPC considered it prudent to wait for the impact of policy actions to play out and greater clarity to emerge before charting the next course of action, and retained the stance at neutral.

Will RBI cut rates in December or wait for impacts of previous policy actions? Analysts in Mumbai opine it cannot be predicted at the moment as trade-related uncertainties continue to unfold.

Data released by the Ministry of Statistics & Programme Implementation shows that there is a decrease of 53 basis points in headline inflation of September 2025 as compared to August 2025. It is the lowest year-on-year inflation after June, 2017. The food Inflation (y/y) rate based on All India Consumer Food Price Index for the month of September 2025 over September 2024 stood at -2.28%. Corresponding inflation rates for rural and urban areas are -2.17% and -2.47%, respectively. A decline of 164 basis points is observed in food inflation in September in comparison to August.

The food inflation in September is the lowest after December 2018. The ministry attributes the decline in headline inflation and food inflation mainly to favorable base effects, and to the decline in inflation of vegetables, oil and fats, fruits, pulses and products, cereal and products, egg, fuel and light etc.

“While much of the moderation has been led by food prices, the core inflation has surged due to housing,” said Upasna Bhardwaj, chief economist, at Kotak Mahindra Bank. Analysts anticipate the pass through of GST cut to be more visible in the upcoming October reading, likely pushing the print to sub-1%.

As far as the rural inflation is concerned, a decrease in headline and food inflation in the rural sector was observed in September. The headline inflation is 1.07% in September while it was 1.69% in August. The CFPI based food inflation in the rural sector is observed as -2.17% in September in comparison to -0.70% in August.

Urban inflation indicated a decrease from 2.47% in August to 2.04% in September as the fall is observed in food inflation from -0.53% in August to -2.47% in September. Housing inflation urban (y/y) for the month of September stood at 3.98% as against 3.09% in August.