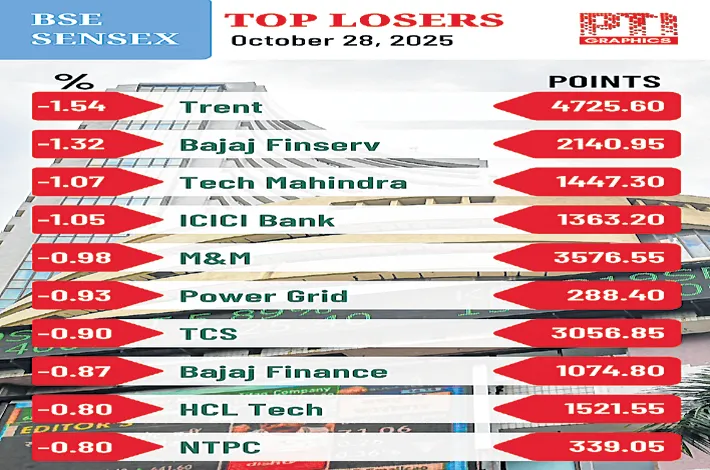

Markets turn volatile ahead of key policy decisions

29-10-2025 12:00:00 AM

FPJ News Service mumbai

The domestic market turned volatile and closed flat on Tuesday, largely weighed down by profit-booking on monthly expiry and weak global cues. Investors are waiting for the outcome of the FOMC meet, and the expected US-China trade pact. Markets also eye the next round of negotiations on the proposed Indo-US BTA, fluctuation in oil prices, and FII fund flows.

The 30-share BSE Sensex declined 150.68 points to close at 84,628.16. During the day, it fell by 559.45 points to 84,219.39. The 50-share NSE Nifty dipped 29.85 points to 25,936.20. According to Dr VK Vijayakumar, chief investment strategist at Geojit Investments, news flows indicate continuation of the positive momentum in the market. There are indications of a possible agreement between US and China on tariffs and if there is a breakthrough in the Trump-Xi meeting on Thursday, that will give another leg up to the markets globally where indices like S&P 500, Nikkei and Kospi are at record highs.

A near-term positive for the market is the expectation that the Fed would cut rates in the FOMC meeting on Wednesday since US CPI inflation (3% y/y) is not as high as feared. There is fundamental support for the Indian market from the leading indicators relating to GDP growth and corporate earnings. The only concern is the relatively high valuations in India which might prompt the FIIs to again turn sellers if the market makes a smart rally.

“Despite the volatility, the metals sector gained renewed optimism following China’s announcement to curb steel overcapacity and potential progress over US-China Trade relations, while public sector banks outperformed amid reports of a potential increase in FII holding limits. Notably, buying interest emerged at lower levels, reflecting underlying investor confidence,” said Vinod Nair, head of research at Geojit Investments.