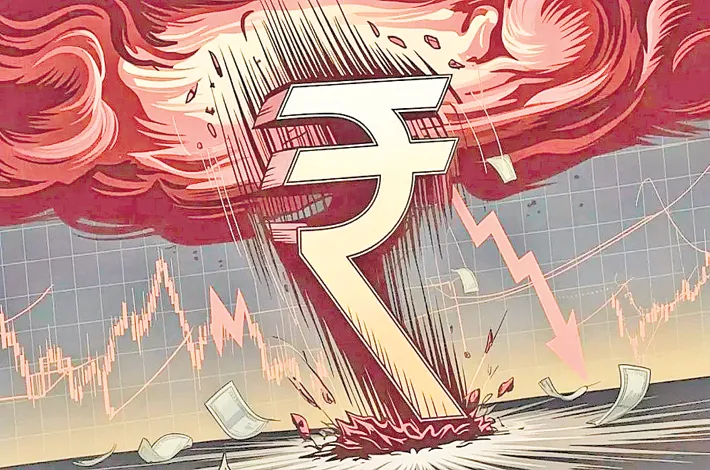

Rupee likely to stay around 90 per US Dollar, expert says

04-12-2025 12:00:00 AM

The Indian rupee is expected to continue its depreciation, with the recent breach of the 90-per-dollar mark becoming the new normal, according to a senior financial expert. Nilesh Shah, head of Kotak Mahindra Mutual Fund and a part-time member of the Economic Advisory Council to the Prime Minister, cited structural factors such as higher inflation and lower productivity compared to India’s trade partners as key reasons for the currency’s weakening.

Shah noted that a 2-3 per cent depreciation in the rupee is a natural outcome given these imbalances. While short-term flows may cause fluctuations in currency levels, he emphasized that there is little scope for the rupee to appreciate on a sustained basis. Depreciation, he added, is also crucial for maintaining export competitiveness amid the current economic conditions.

The expert highlighted the role of the Reserve Bank of India, appreciating that the central bank allows market forces to determine the rupee’s level and intervenes only to curb excessive volatility. According to Shah, the RBI’s recent data suggests a shortfall of USD 50-70 billion in rupee forwards and local markets, prompting interventions to stabilize the currency. However, he clarified that the long-term direction will ultimately be dictated by market dynamics.

When asked whether the 90-per-dollar level represents a new normal, Shah confirmed that it does, and this is likely to persist even if India finalizes the long-discussed trade agreement with the United States.

Shah also urged a review of Press Note 3, a government notification issued in 2020 to restrict investments from neighbouring countries, suggesting that India needs to find ways to attract capital inflows. He emphasized the importance of foreign direct investment as a key driver of economic growth and financial stability.

In sum, according to Shah, the rupee’s depreciation is structurally driven, supported by policy measures aimed at market stability, and likely to remain around the 90-per-dollar mark in the foreseeable future.