SEBI to broaden liquid MF access for REITs & InvITs

22-11-2025 12:00:00 AM

The next phase of India’s infrastructure story must be driven by the dynamism of markets – and within markets, by instruments like REITs and InvITs that connect everyday savings with long-term national assets

FPJ News Service mumbai

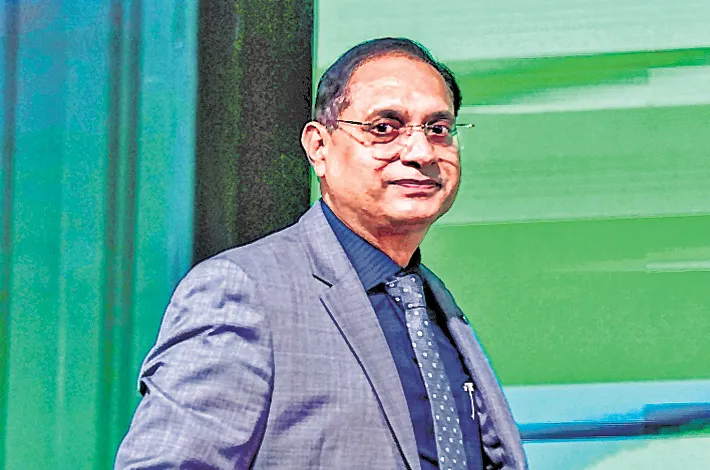

In a decisive push to strengthen India’s alternative investment ecosystem, the Securities and Exchange Board of India (SEBI) is intensifying its engagement with major institutional investors to deepen their participation in Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs), SEBI Chairman Tuhin Kanta Pandey said on Friday. Pandey affirmed that SEBI is working in close coordination with the Ministry of Finance and several state governments to accelerate the monetisation of public assets.

“We are collaborating with IRDAI, PFRDA and EPFO to enable greater participation by entities under their supervision. SEBI will also work with all stakeholders to facilitate the inclusion of REITs in market indices through a calibrated glide path,” he said at the National Conclave on REITs and InvITs 2025 in New Delhi.

Responding to industry inputs, the regulator is examining a new round of reforms to ease business operations for REITs and InvITs.

“We are considering a proposal to expand the permissible basket of liquid mutual fund schemes in which REITs and InvITs may invest, while ensuring robust investor protection. We are further exploring whether private InvITs may be allowed to invest in greenfield projects, subject to necessary safeguards,” he added.

India’s REIT and InvIT universe currently comprises five listed REITs and twenty-four listed InvITs, spanning sectors such as roads, power transmission, renewable energy, telecom, warehousing and commercial real estate.

As of October 2025, the combined assets under management of REITs, InvITs and SM REITs are estimated at Rs 9.25 trillion — roughly Rs 7 trillion in InvITs and Rs 2.25 trillion in REITs and SM REITs.

On the global stage, REITs form a mature and deeply entrenched asset class. United States REITs alone oversee assets exceeding Rs 360 trillion, while Japan and Singapore maintain sophisticated and well-diversified REIT markets. Worldwide, REITs account for around 57% of listed real-estate market capitalisation; India’s share remains comparatively modest at around 12%.

Over the next two decades, India will require massive investment across transport, energy, urban infrastructure, telecom, and aviation. Transport will see strong capital allocation towards capacity expansion and modernization. Power demand will surge, with renewable energy requiring large-scale storage creation. Rapid urbanisation will intensify the need for urban transport, municipal services, waste management, and social infrastructure. NaBFID estimates that India’s core sectors may require well over Rs 700 trillion in investment by 2047. Without sustained financing, India’s aspiration to become a $5 trillion economy will be constrained.