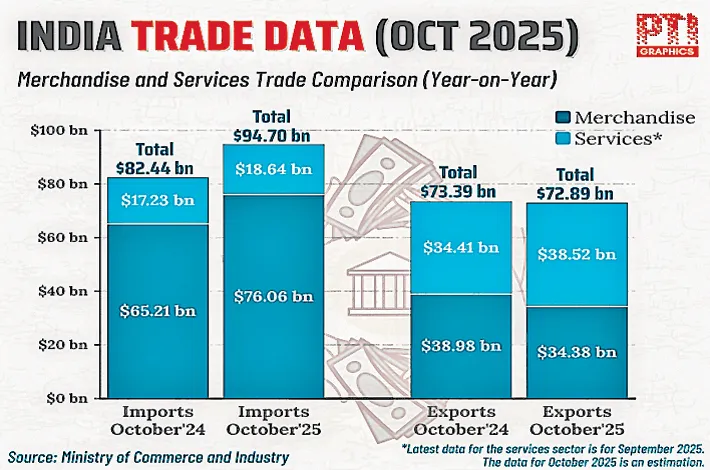

Trade deficit hits all-time high of $41.68 bn; exports fall 12%

18-11-2025 12:00:00 AM

Palazhi Ashok Kumar mumbai

India’s merchandise trade deficit surged to a record $41.68 billion in October 2025, driven by a steep fall in exports to the United States and rising gold imports, data released by the Commerce Ministry revealed on Monday.

US-bound exports fell sharply following the 50% US tariffs on Indian goods, with engineering products, petroleum, gems and jewellery, apparel, chemicals, pharmaceuticals, and plastics all seeing significant declines. Handicrafts, carpets, leather, iron ore, tea, rice, tobacco, spices, and oil meals also posted negative growth.

India’s merchandise exports fell 12% in October 2025 to $34.38 billion as compared to $38.98 billion in October 2024. Merchandise imports during October 2025 were $76.06 billion as compared to $65.21 billion in October 2024. The total exports for October 2025 is estimated at $72.89 billion, registering a negative growth of (-) 0.68% vis-à-vis October 2024. Total imports for October is estimated at $94.70 billion, registering an increase of 14.87% vis-à-vis October 2024.

“Whether tariffs stay or not, India train is moving. India will remain the fastest growing large economy, averaging annual growth of 6.8% over the next three years,” senior economist at a leading European bank said.

“Policymakers face a more uncertain international trading environment. US tariffs across the Asia-Pacific region range from 10% to 50%, and this could not only affect exports but also dampen manufacturers’ investment spending. Aside from the potential impact on exports, this uncertainty also risks dampening investment spending by manufacturers. The latest political and social pressures reduce the policy space that sovereign governments have to support growth,” sources told The FPJ Money.

The Trump administration’s aim to bring manufacturing back to the US (though Trump reiterates as on grounds of national security), and the recent debacle around China’s tighter licensing on rare earth exports are examples of potential strains and disruptions.

Top 5 export destinations (Oct 2025) were China (42.35%), Spain (43.43%), Sri Lanka (29.02%), Vietnam (21.42%) and Tanzania Rep (17.92%). Import sources were Switzerland (403.67%), Hong Kong (93.98%), China (15.63%), U K (194.41%) and UAE (14.38%).