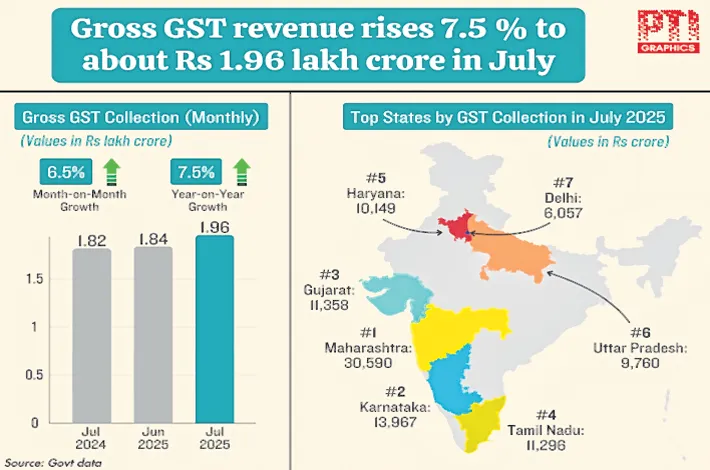

Bhatti champions state interests on tax issues at GST Council meet

22-12-2024 02:54:47 AM

One of the key topics discussed was the applicable tax rate on delivery services provided by delivery partners, including restaurant services through e-commerce operators.

Metro India News | Hyderabad

Deputy Chief Minister and Finance Minister Mallu Bhatti Vikramarka, attended the 55th Goods and Services Tax (GST) Council meeting, chaired by Union Finance Minister Nirmala Sitharaman, in Jaisalmer, Rajasthan on Saturday. Several critical issues related to the GST framework were discussed during the meeting, with Telangana playing a key role in proposing resolutions to ensure fairness and equity in the taxation system.

One of the key topics discussed was the applicable tax rate on delivery services provided by delivery partners, including restaurant services through e-commerce operators. Due to the complexity of these taxation matters, Deputy CM proposed the formation of a Committee of Officers to examine the issue in detail. The Council has agreed to this proposal, and a Committee has been constituted, which includes officers from Telangana, to further investigate and submit a report.

On the matter of the Group of Ministers (GoM) analyzing GST revenue, Bhatti expressed Telangana’s support for the continuation of the GoM, which was initially constituted in 2019. He emphasized that state-wise and sector-wise revenue analysis is vital for making informed policy decisions. The Council supported this recommendation and agreed to the reconstitution of the GoM.

Regarding the recovery of excess ad-hoc IGST apportionment made in previous years, the Deputy CM raised concerns over the methodology proposed for recovery, which was based on the latest period's revenues. He requested that the recovery be made based on the base rate of revenues for FY 2015-16, in line with the original distribution formula. The Council agreed to this approach and decided that any recoveries would only be made in the next financial year to avoid fiscal hardships for states.

Additionally, the Deputy CM opposed the proposal to bring Aviation Turbine Fuel (ATF) under the GST tax net, citing the limited revenue sources available to states. Several other states supported this stance, and the proposal was withdrawn.

In response to a request from Andhra Pradesh for a 1% cess on B2B transactions due to flood damages, Deputy CM Vikramarka urged the Council to extend similar provisions for Telangana, which suffered similar calamity. The matter has been referred to a Group of Ministers (GoM), including Telangana.