Investor sentiment, undercurrent weak amid tariff threats

02-08-2025 12:00:00 AM

Equities extended its downtrend on Friday on renewed tariff fears that could challenge India’s global trade competitiveness.

As think tank GTRT said, Trump’s decision to impose a blanket 25% tariff on all Indian-origin goods effective August 7, without any exemptions, could severely hit India’s exports to America. “Nevertheless, in general, Indian markets perceive the 25% tariff as a short-term issue. The rate is likely to come down after the next round of negotiations beginning this month, veteran investment strategist Dr VKV told The Free Press Journal Money.

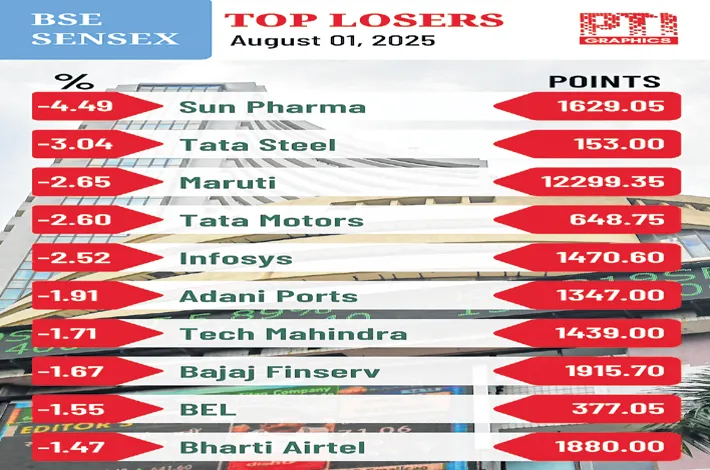

In a volatile trade, the 30-share BSE Sensex tumbled 585.67 points to settle at 80,599.91. During the day, it dropped 690.01 points to 80,495.57. The 50-share NSE Nifty declined 203 points to 24,565.35.

As Warren Buffett (one of the greatest investors of all time) once pointed out, the stock market is a device for transferring money from the impatient to the patient.

FIIs offloaded securities worth Rs 8,955 crore in two days (Thursday and Friday).

Bajaj Broking Research said, “The Nifty-50’s downside was exacerbated by the US Fed’s persistently hawkish tone, with no signals of an imminent pivot toward rate cuts, thereby denting investor “appetite for risk assets’.

“The Indian market extended its decline for a second day, pressured by renewed tariff threats and punitive duties. Investor sentiment weakened further as FIIs now hold the second-highest net short position in derivatives, reflecting elevated caution. Globally, markets turned negative amid rising US inflation and trade tensions. While the sell-off was broad-based, FMCG stocks emerged as a defensive play, supported by attractive valuations, resilient demand, and relative immunity to external trade disruptions,” said Vinod Nair, head of research at Geojit Investments.

An important trend in the market is the weakness in the broader market, particularly the smallcaps.