100 bps CRR cut to release `2.5L cr

07-06-2025 12:00:00 AM

The stress witnessed earlier in retail segments like unsecured personal loans and credit card receivables portfolio has abated, while the stress in micro-finance segment is persisting

FPJ News Service mumbai

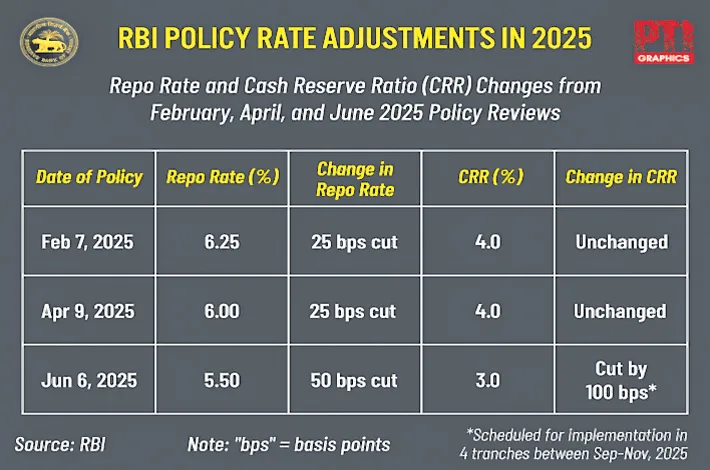

The Reserve Bank’s decision to cut the cash reserve ratio (CRR) by 100 basis points to 3% would release primary liquidity of about Rs 2.5 lakh crore to the banking system by December 2025. The CRR will be reduced to 3% of net demand and time liabilities in a staggered manner during the course of the year. The move will reduce the cost of funding of banks, thereby helping in monetary policy transmission to the credit market.

A total amount of Rs 9.5 lakh crore of durable liquidity was injected into the banking system since January. As a result, after remaining in deficit since mid-December, liquidity conditions transitioned to surplus at the end of March. This is also evident from the tepid response to daily VRR auctions and high SDF balances–the average daily balance during April-May amounted to Rs 2.0 lakh crore.

Reflecting the improvement in liquidity conditions, the weighted average call rate (WACR)–the operating target of monetary policy–traded at the lower end of the LAF corridor since the last policy. “The comfortable liquidity surplus in the banking system has further reinforced transmission of policy repo rate cuts to short term rates. However, we are yet to see a perceptible transmission in the credit market segment, though we must keep in mind that it happens with some lag,” underlined RBI governor Sanjy Malhotra.

The system-level financial parameters of scheduled commercial banks, Malhotra said, continue to be robust. The asset quality parameters, liquidity buffers and profitability parameters have shown further improvement.

Credit Deposit ratio for the banking system at the end of December 2024 was at 81.84%, broadly similar to a year ago. Similarly, the system-level parameters of NBFCs too are sound with comfortable capital position and improved GNPA ratios. The stress witnessed earlier in retail segments like unsecured personal loans and credit card receivables portfolio has abated, while the stress in micro-finance segment is persisting.

“Banks and NBFCs active in these segments are already recalibrating their business models, strengthening their credit underwriting practices and stepping up their collection efforts to avoid any excessive build-up of risks on this front in future,” the governor added.