Economy on growth path despite global uncertainties

30-04-2025 12:00:00 AM

Fin Min report | Trade Policy Uncertainty Index up 101.3% in Q1

FPJ News Service mumbai

Forecasters are revising global growth estimates downwards amidst fear of continuing policy uncertainties amidst trade protectionism. Despite the risk posed by global headwinds, the domestic economy continues to show signs of resilience backed by domestic drivers. High-frequency indicators suggest that the domestic economy recorded robust performance in the last quarter of FY25, the March edition of Monthly Economic Review released by Department of Economic Affairs said on Tuesday.

Nevertheless, as a major emerging market economy, India, too, faces distinct challenges and opportunities amid escalating global geopolitical tensions. The country remains vulnerable to spillover effects from international geopolitical events as the world's fifth-largest economy with substantial integration into global trade and financial networks.

"The Trade Policy Uncertainty Index increased by 101.3% in Q1 FY25 compared to Q4 FY24, indicating a sharp deterioration from the relative stability observed between 2021 and 2023. This rise reflects notable trade and tariff-related policy changes among major countries. As these developments unfold, their potential global impact on investments and trade flows warrants careful consideration and analysis," the report said.

Gross GST collection jumped to 1.96 lakh crore in March 2025 on the back of buoyant economic activity. GST collection rose to Rs 22.1 lakh crore in FY25 (Apr-Mar), compared to Rs 20.2 lakh crore in FY24, recording a year-on-year (yoy) growth of 9.4%. Complementing this, the e-way bill generation recorded growth of 20.2% in March 2025. Notably, Q4 of FY25 recorded the highest YoY growth of 19.4% in e-way bill generation in FY25, indicating heightened economic activity in Q4 compared to previous quarters of the financial year.

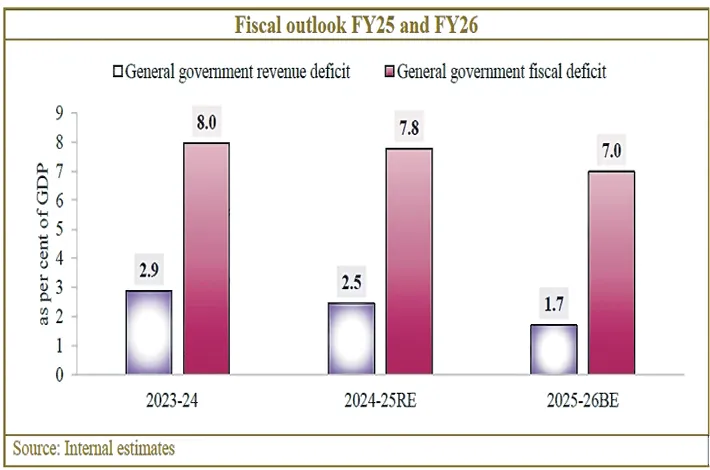

An assessment of general government finances from the FY25 and FY26 budgets of the Union and state governments reflects steady progress in fiscal consolidation. Revenue and fiscal deficits relative to GDP continue to decline. This has increased the availability of domestic savings for financing private investment in the economy.

The glide path of government debt announced in the budget will ensure a still higher availability of domestic savings for private investment. If states are able to reduce their debt burden going forward, there would still be a higher availability of domestic savings for private investment. While the underlying economic conditions vary across states, a concerted effort to improve the quality of expenditure and rein in deficits by states is crucial to achieve medium-term fiscal consolidation and support macroeconomic growth & stability.