Heavyweights win investors’ hearts

12-11-2025 12:00:00 AM

Nvidia, the most valuable company in the world, is trading at 51 times earnings, Indian retail investors are investing in IPOs priced at 230 times earnings. These are unhealthy trends, and time for caution

FPJ News Service mumbai

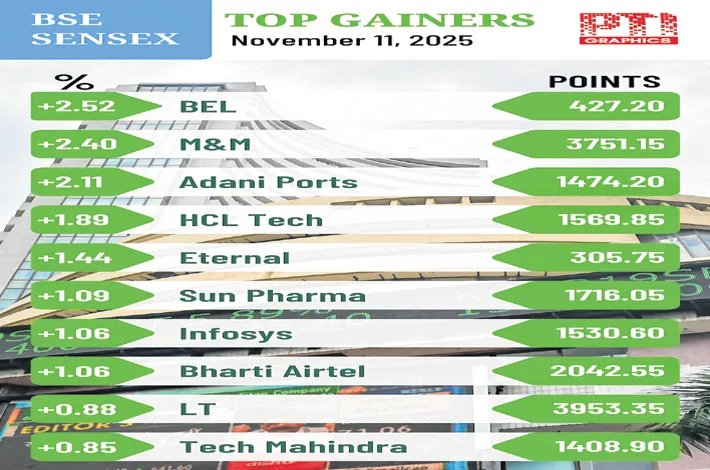

Renewed buying interest in heavyweights supported markets to recover smartly on Tuesday despite concerns over potential implications of the Monday’s Delhi explosion. Global cues such as the bill that the US Senate passed to end the longest-ever (from October 1) government shutdown. Though the 30-share BSE Sensex began the trade on a negative note by declining 411.32 points, it jumped 336 points to settle at over 83,871, while the Nifty climbed nearly 121 points to close at 25,694.95.

“The market opened on a subdued note amid concerns over implications of the explosion. However, it recovered smartly and closed at the day’s high, supported by global cues. More importantly, the Q2 results season is nearing its end and is expected to conclude on a positive note, driven by better-than-expected performance by the broader market,” said Vinod Nair, head of research, Geojit Investments.

“The AI trade which was weak last week has again bounced back with a 2.2% gain in Nasdaq. While there is concern that the return from AI stocks will take much longer-than-expected presently, it is a fact that there is no bubble yet in AI stocks, particularly when compared to the Tech bubble which crashed in 2000. In March 2000 Nasdaq PE was above 70 and many tech stocks were trading above 150 PE. Now Nasdaq is trading at 32 PE and the valuations of AI stocks range from 28 to 51. Therefore, the AI trade may continue for some more time, and so long as this trade persists, FIIs, particularly hedge funds, may continue to sell in India. This will weigh on Indian markets.

“Investors have to give priority to valuations and safety now. While Nvidia, the most valuable company in the world, is trading at 51 times earnings, Indian retail investors are investing in IPOs priced at 230 times earnings. These are dangerous, unhealthy trends. Time for caution,” Dr VK Vijayakumar, chief investment strategist at Geojit Investments, said.