ICAI submits proposal to centre for joint income tax return filing

23-01-2026 12:00:00 AM

Several countries, including the United States and Germany, already allow married couples to file income tax returns jointly

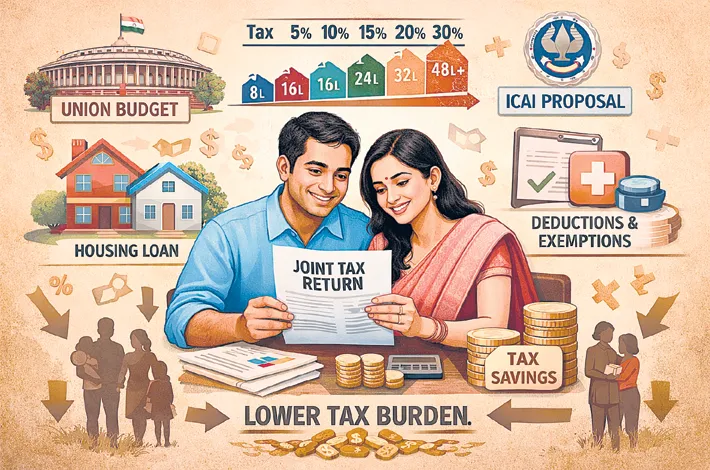

The Union government is considering a proposal to provide income tax relief to married couples by allowing husbands and wives to file income tax returns jointly. The move is expected to reduce the overall tax burden on families by enabling better sharing and full utilisation of tax exemptions and deductions. The proposal has been submitted to the Centre by the Institute of Chartered Accountants of India (ICAI), along with several organisations and individuals, and is likely to be taken up for consideration in the forthcoming Union Budget.

Under the existing income tax system, returns are filed individually and exemptions related to insurance premiums, house rent allowance, housing loan interest, children’s education expenses and other eligible costs are subject to individual income limits. Even if either spouse bears these expenses, the deductions can be claimed only in their individual return. As a result, in households where only one spouse is earning or where there is a significant gap in incomes between husband and wife, the available exemptions often remain underutilised.

If joint filing of income tax returns is introduced, married couples would be able to pool their incomes and share deductions and exemptions. This would help them fully claim eligible benefits and reduce the total tax payable. Experts point out that such a system would be particularly beneficial for single-income families and households where one spouse has little or no taxable income.

ICAI has also proposed a separate joint tax slab structure for married couples. According to the recommendation, no income tax should be levied on combined income up to Rs 8 lakh. Income between Rs 8 lakh and Rs 16 lakh would be taxed at 5 per cent, Rs 16 lakh to Rs 24 lakh at 10 per cent, Rs 24 lakh to Rs 32 lakh at 15 per cent, Rs 32 lakh to Rs 40 lakh at 20 per cent, Rs 40 lakh to Rs 48 lakh at 25 per cent, and income above Rs 48 lakh at 30 per cent.

In addition to tax relief, joint filing of returns is expected to make it easier for couples to take joint loans for housing and other needs, as financial institutions would have a clearer picture of household income. It is also expected to support better financial planning and bring greater transparency to family finances.

Several countries, including the United States and Germany, already allow married couples to file income tax returns jointly. If the proposal is incorporated in the upcoming Budget, it would mark a major shift in India’s income tax system and could be seen as a move towards a more family-oriented taxation framework.