Investors discombobulated; markets await new triggers

08-11-2025 12:00:00 AM

FPJ News Service mumbai

Investors, in general, are discombobulated as there are no immediate triggers in sight to boost the markets. However, several positive macroeconomic fundamentals of the Indian economy are expected to support the long-term undercurrent.

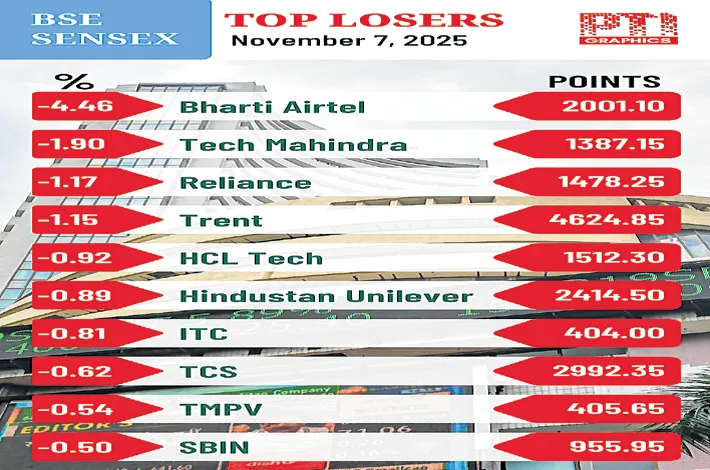

Mirroring the downtrend trend for the third consecutive session, the 30-share BSE Sensex lost 94.73 points on Friday to settle at 83,216.28. The 50-share NSE Nifty dipped 17.40 points to 25,492.30.

“A significant feature of the present market trend is that despite the DIIs buying far more than what the FIIs are selling (Rs 5,283 crore DII buying vs Rs 3,263 crore FII selling on November 6) the market continues to drift down. The huge shorting by FIIs are overpowering the DII and investor buying in the market. The success of the FII strategy of sustained selling in India and moving money to cheaper markets has emboldened them to continue the strategy and continue shorting the market. Short-covering can lead to trend reversal but there are no immediate triggers for that in sight. But markets have an uncanny ability to surprise,” said Dr. VK Vijayakumar, chief investment strategist, Geojit Investments.

“This is an ideal time for investors to churn portfolios in favour of fairly-valued large caps. FII selling has reduced the prices of fairly valued large caps particularly in banking and pharmaceuticals where growth prospects continue to be bright,” he said.

“Select segments found support from Q2 results, with broader indices outperforming, led by a sharp rally in financials—especially PSU banks on account of rising investor interest driven by speculation around an FDI cap hike and sector consolidation. Going forward, markets will closely monitor US shutdown and tariff-related developments with US-India and US-China deals to assess the durability of the current momentum,” said Vinod Nair, head of research, at Geojit Investments.

Bharti Airtel shares lost 4.46% after Singtel said it has sold about 0.8 per cent stake in the firm for Rs 10,353 crore.