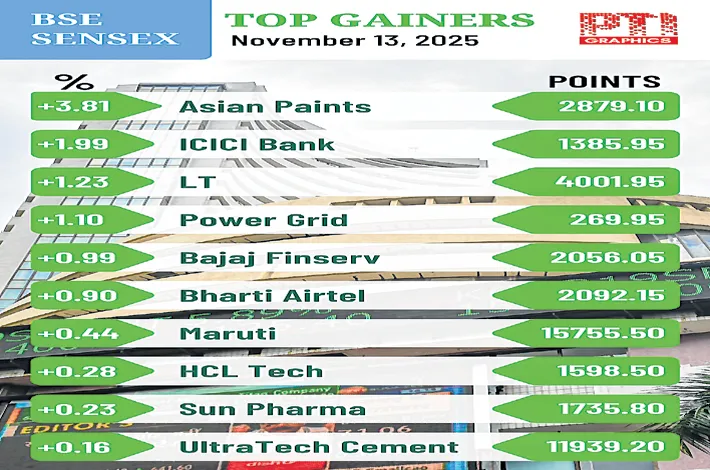

Markets close flat on profit-booking

14-11-2025 12:00:00 AM

FPJ News Service mumbai

The domestic stock markets settled flat on Thursday on profit-booking, erasing early gains despite favourable global and domestic cues. The 30-share BSE Sensex settled with a slight gain of 12.16 points at 84,478.67. The NSE Nifty closed the session with just 3.35 points higher at 25,879.15.

“Sentiment was buoyed by Trump signing a short-term funding bill to end the US government shutdown and hopes of tariff relief for India. The record-low October inflation prints reinforced expectations of an RBI rate cut, making rate-sensitive sectors like metals and realty attractive to investors. However, amidst continued outflows from FII and a weak rupee, profit-booking emerged at elevated levels ahead of the Bihar election results, expected by late Friday, which left the benchmark indices largely unchanged by the close,” Vinod Nair, head of research at Geojit Investments, said.

“The market needs more triggers to take it to new record highs. With the outcome of the Bihar polls largely discounted by the market, there are no political triggers that can push the market significantly higher. The reverse might happen if the actual poll results turn out to be different from the exit polls.

“The important economic factors that have to be watched for is a possible India-US trade deal removing the penal tariffs and reducing the reciprocal tariffs. The decline in October retail inflation in India to 0.25% indicates the possibility of a rate cut from the MPC in December. But the monetary policy transmission turning weak has become a challenge for the RBI,” pointed out Dr VK Vijayakumar, chief investment strategist, Geojit Investments.

In the near-term, Dr VKV said, the market is likely to consolidate and then respond to triggers when they happen. Positive triggers happening simultaneously can lead to short-covering pushing the market sharply up. But sustained uptrend would be challenging given the FII selling and elevated valuations.