Mkts stage a robust rebound

16-05-2025 12:00:00 AM

POINTS TO PONDER

- FIIs buy equities worth Rs 5,393 cr

- Sensex climbs 1,200 pts

- NSE Nifty hits 7-month high of 25,062 pts

- Tata Motors biggest gainer, scrip jumps 4%

- Defence stocks’ valuations stand high, investors told to be cautious; long-term prospects bright

- Marketmen to explore Fed chair’s statement

FPJ News Service mumbai

Markets staged a robust rebound on Thursday with substantial gains, driven by a decline in domestic inflation, and positive signals from the US regarding a potential trade agreement with India.

BSE Sensex soared by 1,200 points while NSE Nifty settled above the 25,000 mark for the first time in seven months on Thursday following across-the-board buying by investors and fresh foreign fund inflows into shares.

The 30-share BSE Sensex climbed 1,200.18 points (1.48%) to settle at a seven-month high of 82,530.74 with 29 of constituents ending higher. The index moved in a range in the first half but picked up momentum in the afternoon session following sharp gains in banking, auto, IT and oil & gas shares. The NSE Nifty surged 395.20 points (1.60%) to settle at a seven-month high of 25,062.10. The 50-issue index had closed above 25,000 on October 15, 2024, previously.

Investors’ wealth increased by Rs 9 lakh crore in two days to Rs 440 lakh crore (approximately $5.14 trillion). Sectoral indices closed higher, with realty surging 1.87%, auto (1.86%), services (1.85%), industrials (1.62%), metal (1.60%), consumer discretionary (1.57%) and commodities (1.51%).

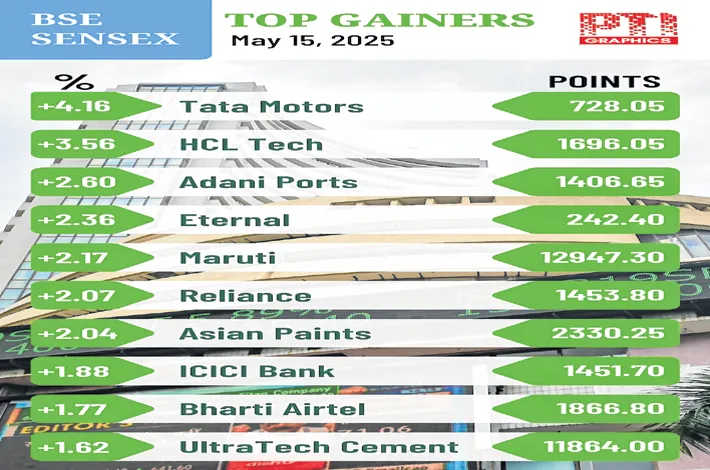

Tata Motors was the biggest gainer, gaining by over 4%. HCL Tech, Adani Ports, Eternal, Maruti, Reliance Ind and Asian Paints were among other gainers. HDFC Bank, ICICI Bank, Bharti Airtel and Infosys have contributed to the market rally.

On the defence stocks witnessing smart gains (after the PM’s appreciation of the performance of made in India defence weapons) Dr VK Vijayakumar, Chief Investment Strategist at Geojit Investments, said, “The medium to long-term prospects of defence companies, particularly those of exporters, look bright. However, the valuations of these stocks are high, and, therefore, investors have to be cautious. A further rally in mid and smallcaps is likely despite the valuation concerns.”

“The benchmark index outperformed the broader market, buoyed by growing optimism around a potentially “more accommodative” monetary policy stance. Rate-sensitive sectors such as automobiles and real estate led the rally, supported by upbeat industry forecasts. Investor attention is now turning to the speech by the Fed Chair (late Thursday), which is anticipated to provide further clarity on the future policy trajectory, particularly in light of the recent easing in US inflation data,” said Vinod Nair, Head of Research at Geojit Investments.