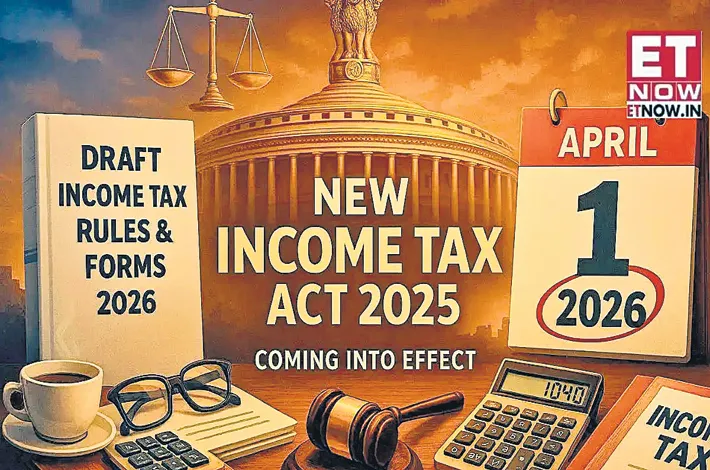

New draft tax rules-What changes?

16-02-2026 12:00:00 AM

The Indian government has released the Draft Income Tax Rules 2026, proposing significant updates to how Permanent Account Number (PAN) requirements apply to various financial transactions. These changes, set to take effect from April 1, 2026, aim to ease compliance for smaller deals while increasing scrutiny on larger cash movements and high-value activities. The draft consolidates the existing 511 rules into a more streamlined 333, supporting a shift toward a digital, efficient tax system.

One key proposal relaxes PAN mandates for vehicle purchases. Currently, PAN is required for all motor vehicle buys, regardless of value. Under the new rules, it would only be mandatory if the vehicle's cost exceeds Rs 5 lakh. This means buyers of budget cars, two-wheelers, or lower-priced vehicles would face less paperwork.For cash payments at hotels or restaurants, the threshold for mandatory PAN disclosure is proposed to rise significantly.

The existing limit requires PAN for single cash transactions of Rs 50,000 or more. The draft increases this to Rs 1 lakh per transaction, reducing the compliance burden for moderate dining or stay expenses paid in cash.Life insurance policies see a shift in compliance timing. Presently, PAN disclosure is required if annual cumulative premiums cross Rs 50,000. The proposal moves this requirement to the policy onboarding stage itself, meaning PAN would need to be provided when initiating the policy, similar to bank KYC processes, rather than monitoring annually.Property transactions also benefit from a higher threshold.

The current rule mandates PAN for deals above Rs 10 lakh. The draft doubles this to Rs 20 lakh, which could simplify smaller real estate purchases or sales, particularly in tier-2 and tier-3 cities. On the monitoring side, the draft introduces clearer rules for cash withdrawals from savings accounts. It proposes mandatory PAN disclosure if aggregate cash withdrawals in a financial year reach Rs 10 lakh or more (across one or more accounts).

This aims to enhance traceability for larger cash outflows, though some reports note similar thresholds for deposits as well. These proposals are part of broader efforts to modernize the tax framework, aligning with the new Income Tax Act, 2025. The draft rules are open for public comments until February 22, 2026, after which final notifications will confirm the changes. Taxpayers are advised to stay updated, as the revisions balance reduced hassles for routine transactions with greater visibility into substantial financial activities.