PSU Banks merger- Scale vs Scope factor

22-11-2025 12:00:00 AM

In a significant policy hint earlier this month, Finance Minister Nirmala Sitharaman confirmed that the government is actively considering further consolidation of public sector banks (PSBs) to create fewer but larger “world-class” banks capable of supporting India’s ambition of becoming a $5-trillion economy and a developed nation by 2047.

The statement has reignited the debate on bank mergers, five years after the last major round that reduced the number of PSBs from 27 in 2017 to 12 today. Experts offered a cautious but realistic assessment of the proposed consolidation. While acknowledging the need for scale to finance mega infrastructure projects and compete globally, the panel stressed that size alone will not guarantee success unless accompanied by stronger growth levers, cultural integration, and prudent risk management.

Investors in high-performing smaller PSBs such as Bank of Maharashtra and Indian Overseas Bank have expressed anxiety that a merger with a slower-growing larger entity could dilute their returns. A former RBI Governor however, downplayed short-term market reactions, pointing out that the government remains the majority shareholder in all PSBs and is equally focused on protecting overall value. He noted that informed investors understand the benefits of a larger balance sheet, better technology, and economies of scale, even if headline growth percentages appear lower post-merger.

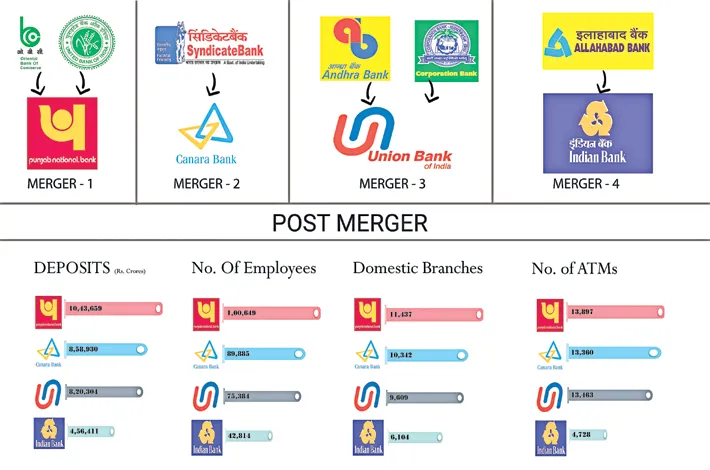

The previous round of consolidations — which saw Vijaya Bank and Dena Bank merge into Bank of Baroda, Oriental Bank of Commerce and United Bank into Punjab National Bank, and Allahabad Bank into Indian Bank, among others — is widely regarded as a long-term success despite initial integration pains. Profitability and efficiency gains are now visible, reflected in improved share prices of the merged entities.

Yet cultural integration remains the biggest lingering challenge, the panel agreed. Another retired MD of a nationalized bank who steered one of the mergers, emphasised that positioning any amalgamation as a “merger of equals” under the same government ownership, coupled with transparent HR policies and constant communication, is critical to maintaining employee morale and productivity.

The bankers unanimously cautioned against mergers for the sake of size alone. Another former Chairman of a leading public sector bank argued that consolidation must strengthen “growth muscles” — superior risk-underwriting ability, technology, talent, and optimal use of scarce capital. Merging high-capital-adequacy banks with capital-constrained ones, or entities offering clear business synergies, would make more sense than simply combining the largest players.

He noted that global giants like China’s ICBC ($7 trillion) and JPMorgan Chase ($4 trillion) dwarf even a combined Indian entity, suggesting that true global scale remains distant without addressing deeper governance issues. Creating one or two mega-banks with Rs 25–30 lakh crore deposit bases by further merging already-consolidated giants (such as Punjab National Bank, Union Bank, or Bank of Baroda) received lukewarm support.

The elephant in the room: Governance reform

A recurring theme was the stark valuation gap: the combined market capitalisation of India’s top five private banks still exceeds that of all 12 PSBs put together. The ex- RBI executive and others reiterated long-standing recommendations to eventually move PSBs from the Bank Nationalisation Act to the Companies Act, reduce government stake to 51% or lower over time, and create truly independent boards. While politically sensitive, subtle hints from the Finance Minister suggest the idea is back on the table.

A retired bureaucrat who is associated with an economic think tank flagged three systemic risks if consolidation is mishandled-Creating institutions so large that their failure would threaten the entire financial system, without commensurate regulatory bandwidth to supervise them, Eroding regional and local lending, especially to agriculture, MSMEs, and priority sectors, as mega-banks focus on corporate and infrastructure lending, Expecting new global-scale Indian banks to finance the very high-risk project finance segments that caused the last NPA crisis — an area commercial banks should ideally avoid.

While the strategic intent behind creating larger banks is unquestioned, the veteran bankers urged the government to prioritise synergy, cultural fit, technology readiness, and transparent HR practices over mere arithmetic addition of balance sheets. Regional strengths, local language capabilities, and niche expertise must not be sacrificed on the altar of scale.