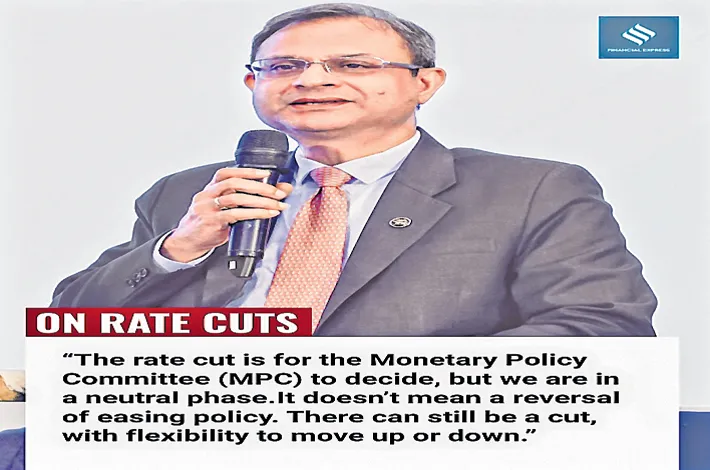

‘Rate cuts won’t lead to asset bubbles’

26-07-2025 12:00:00 AM

ECONOMY | Reserve Bank has more ammunition in its arsenal beyond rate cuts

FPJ News Service mumbai

Reserve Bank Governor Sanjay Malhotra on Friday said rate cuts will not lead to asset bubbles and added that the central bank has more ammunition in its arsenal beyond rate cuts to help the economy. till June suggest that banks’ lending rates have declined by around 0.50% this year, the same as the RBI’s rate cuts till then, signalling a complete transmission of the RBI’s decision.

The rate cuts are aimed at upping the credit growth, Malhotra said, exuding confidence that they will not lead to the creation of asset bubbles. He said the 12.1% credit growth for FY25 is better than the decadal average of over 10%, but admitted that the number is trailing at around 9% levels in FY26. He assured the industry that the RBI will provide “the right macroeconomic conditions for growth” through its policies, liquidity stance and regulatory moves.

With data showing a steep decline in price rise in June, Malhotra Friday said that the outlook on inflation and growth will determine future rate cuts, making it clear that the current data will not influence the trajectory.

Speaking at the Financial Express BFSI event here, Malhotra said, rate cuts will depend on the outlook for both growth and inflation rather than the current numbers. “We have to remember that monetary policy works with a lag and hence outlook on the outcomes on key data like inflation for up to 12 months is kept in mind while taking the rate calls.” He reminded that as per the current projections, CPI is expected to rise to 4.4% in Q4, but admitted that the current outcomes suggest there will be a downward revision to the number.

The governor reiterated the RBI’s concerns about allowing industrial houses to promote banks, saying any entity undertaking a real economy, along with financial sector activity, exposes the system to potential conflicts of interest. It is only the voting rights which are capped at 26% as per the Banking Regulation Act, and even foreign banks can have up to 100% shareholding in a domestic bank. At present, the government is subsidising the payments infrastructure given its huge benefits, and in the future, there will be a need to have payments either by the state or users to ensure that the system keeps on, Malhotra said.

It can be noted that the RBI has cut its key rates by 1 percentage point this year, and official data pointing to headline inflation cooling to 2.1% against the 4% target has led to expectations of further easing. The shift in stance to “neutral” from “accommodative” suggests that the bar for delivering a rate cut is much higher now, Malhotra added. CRR cut is not just a liquidity move, but an attempt to reduce the cost of intermediation, which will help lower the borrowing costs as well.