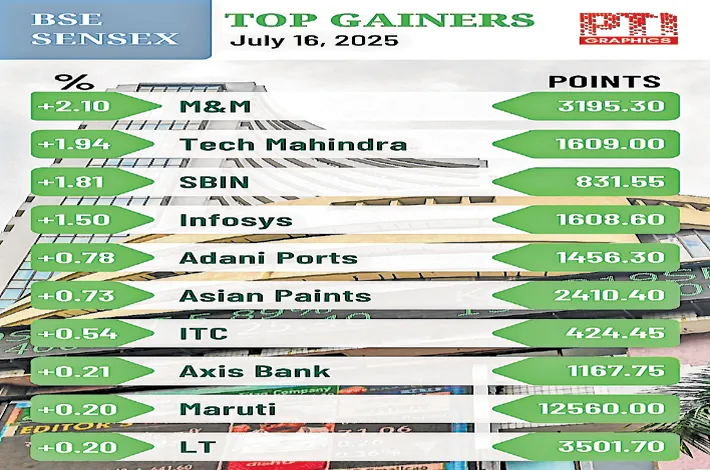

Stock mkts cautious amid global tariff uncertainties

17-07-2025 12:00:00 AM

FPJ New Service mumbai

Markets remained cautious on Wednesday amid weak global trends and tariff-related uncertainties. Rising for the second day in a row, the 30-share BSE Sensex edged up 63.57 points to close at 82,634.48. During the day, it hit a high of 82,784.75 and a low of 82,342.94. The 50-share NSE Nifty settled 16.25 points higher at 25,212.05.

“India’s macroeconomic outlook remains strong, supported by easing inflation, lower interest rates, a healthy monsoon, and softer oil prices. A drop in inflation in eight straight months has provided a push to the market. However, investors are showing a mix of optimism and caution in the relief rally to assess the Q1FY26 corporate earnings, as an upgrade in earnings is essential in the premium valued stock market,” said Vinod Nair, head of research at Geojit Investments.

“The market has been oscillating in a narrow range during the last two months. A breakout above the upper band of the range, well beyond Nifty 25500, needs positive triggers. Such a trigger may come from an India-US trade deal with tariffs on India pegged at around 20 percent. If this happens, can it trigger a sustained rally in the market? Unlikely,” said Dr VK Vijayakumar, chief investment strategist at Geojit Investments.

“A sustained rally in the market needs earnings support. There are no signs of strong earnings support and earnings growth visibility. Two big segments of the market-IT services and consumption, particularly FMCG-are struggling with tepid earnings. There are green shoots of earnings recovery in FMCG but IT services continue to struggle.

This means earnings growth for FY26 will be around 10% only. This is the biggest challenge being faced by the market now. Therefore, investors can be stock-specific, focusing on stocks where growth prospects and earnings visibility are bright," Dr Kumar, said.