Sustained FII fund inflows restrict market pessimism

30-04-2025 12:00:00 AM

FPJ News Service mumbai

Geopolitical tensions not only distress policymakers, but they also make domestic investors worry about their investments, and the economy. Benchmark indices Sensex and Nifty settled marginally higher in a volatile trade on Tuesday as investors turned cautious amid concerns over geopolitical tensions.

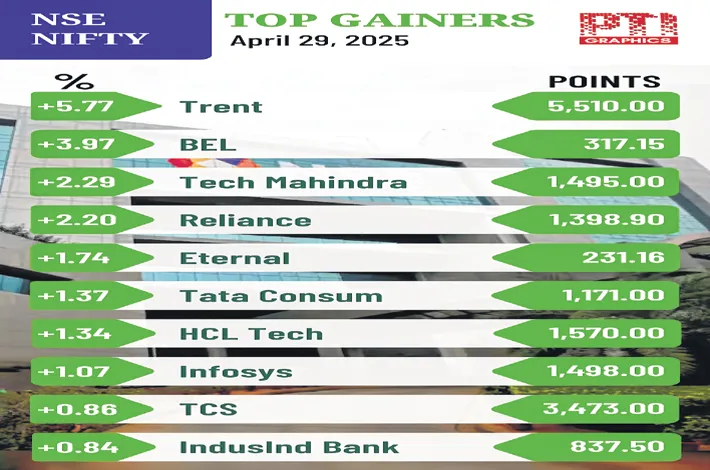

However, intense buying in blue-chips Reliance Industries, Infosys and TCS and unabated FIII fund inflows supported the market. The 30-share BSE benchmark gauge climbed 70.01 points to settle at 80,288.38. The NSE Nifty closed marginally up by 7.45 points to 24,335.95. FIIs bought equities worth Rs 2,385.61 crore on Tuesday.

Investors term the current trade conflicts as a classic war of conquest created by President Trump. The India-Pakistan tensions are created by vested interested groups of terrorists with a long-term objective of fragmentation in the region. The aftermath, according to economic gurus, is de-globalization. “We are optimistic about a mutually beneficial bilateral trade deal between India and the US, and the market is expected to maintain its resilience,” opined a high-net-worth individual investor.

“The market exhibited largely range-bound oscillation, as caution prevailed amid geopolitical concerns over border tensions. The sustained inflows from FIIs provided support to market sentiment, and restricted further pessimism. Meanwhile, mixed Q4 results have raised the risk of downward revisions to FY26 projections,” said Vinod Nair, Head of Research, Geojit Investments.

According to Ajit Mishra, SVP, Research, Religare Broking, beyond the strong performance from banking and financials, “we are now witnessing rotational buying in heavyweight stocks from sectors such as IT, energy, and auto. This trend could support the index in maintaining its positive bias. Hence, any short-term pause or consolidation should be viewed as healthy.”