Australia tightens student visa applications

14-01-2026 12:00:00 AM

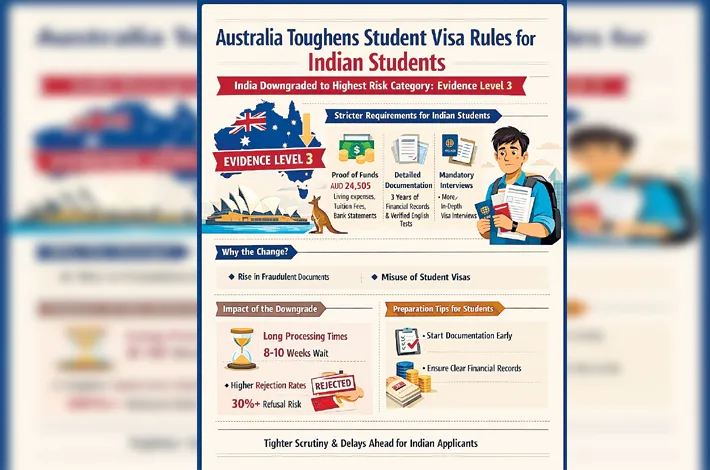

Reclassifies India into ‘Evidence Level 3’ the most restrictive level

There is also growing concern over refusal rates. When Nepal was moved into Evidence Level 3 in 2023, rejection rates crossed 30 percent within months

The worst fears have been confounded as Australia has finally decided to tighten admission offers to Indian students and placed India in the highest-risk category. According to an update to the Simplified Student Visa Framework (SSVF), Australia’s Department of Home Affairs has reclassified India into Evidence Level 3, the most restrictive level. The change means Indian students must now meet significantly tougher documentation and verification requirements before securing a visa. Nepal was moved into Evidence Level 3 in 2023.

India had remained at Evidence Level 2 for the past four years, a relatively favorable position that helped more than 120,000 Indian students enroll in Australian universities and vocational institutions in 2025 alone. This downgrade, officials say, reflects “emerging integrity risks” detected within the student migration system.

According to Australian authorities, those risks include a rise in fraudulent financial documents, inconsistent academic records, and a growing number of applicants enrolling without genuine intent to study. Since late 2024, visa officers have indicated the increased cases of misuse, prompting what officials describe as an “out-of-cycle” reassessment of risk.

As a result, all Indian applicants are now required to provide extensive proof of financial capacity, including evidence covering 12 months of living expenses set at AUD 24,505, in addition to tuition fees and travel costs. In many cases, applicants may be asked to submit bank statements covering up to three years, income tax returns, and verified English-language test scores.

Interviews, once selectively applied, are also expected to become more common. Education consultants warn that the immediate impact will be delayed. Processing times, which previously averaged around four weeks, are now expected to stretch to eight to ten weeks, placing the July 2026 intake at risk for many students who are still awaiting offers or preparing documentation.

There is also growing concern over refusal rates. When Nepal was moved into Evidence Level 3 in 2023, rejection rates crossed 30 percent within months, according to migration data reviewed by education agents. A similar trend could emerge for Indian applicants if documentation standards are not met precisely.

Australian universities have already been advised to tighten admission offers and keep closer watch on student progression and drop-out rates. Several institutions are reassessing their dependence on international enrolments amid pressure from the federal government to ensure compliance.

For Indian students, this preparation will matter more than ever. Advisors are urging applicants to begin documentation early, ensure financial records are transparent, and avoid last-minute filings.

US student loan reset 2026

Student loan borrowers across the United States are bracing for a major overhaul of the federal repayment system beginning in 2026, a shift that could redefine how millions repay education debt and influence decisions of Indian and other international students planning to study in the country.

At the heart of the reform is a plan to merge all federal student loans into a single income-based repayment programme. Once fully implemented, it will replace the current mix of repayment options, linking monthly payments directly to earnings and offering loan forgiveness after roughly 30 years.

For recent graduates, the change promises greater predictability. For older borrowers already under financial strain, it could determine whether they stay afloat or slide into default. With US student loan default rates already rising, experts warn that the winding down of the SAVE programme may intensify stress for low-income borrowers.

Chip Lupo, an analyst at WalletHub, said the transition period will be critical. Some provisions are already in effect, with others rolling out from July and continuing through 2026.

A key reform removes the requirement to prove “partial financial hardship” to qualify for income-driven repayment, significantly widening eligibility. Graduate borrowing will also be capped, ending unlimited federal loans under some programmes.

Though international students rarely access federal loans, the ripple effects could be significant. Tighter caps may push universities toward private financing, potentially raising costs for non-citizens.

Another notable change: from July 1, 2026, loans placed in forbearance will be treated as taxable income, risking surprise tax bills. For Indian students eyeing US education, the message is clear—financing assumptions are shifting, and careful planning has never been more essential.