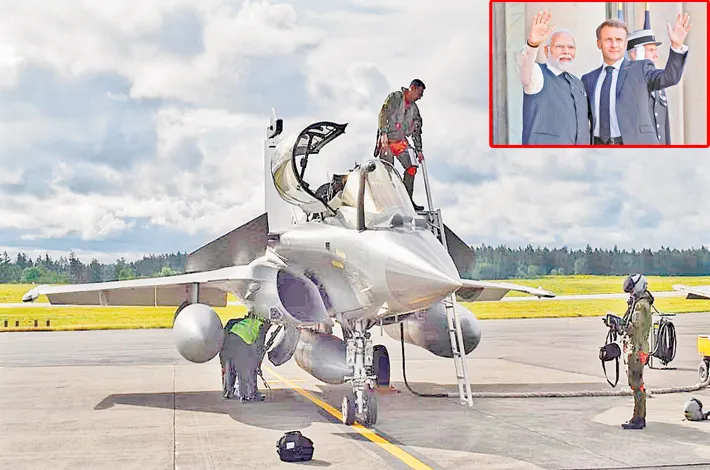

India banks on Raffalle again!

17-01-2026 12:17:44 AM

India is on the verge of finalizing what could become its largest-ever defence procurement deal: a massive Rs 3.25 lakh crore agreement with France for 114 advanced Rafale fighter jets to bolster the Indian Air Force (IAF). This proposal, currently under intense discussion within the Defence Ministry, aligns closely with the Make in India and Atmanirbhar Bharat initiatives, emphasizing domestic manufacturing and technological integration.

Under the proposed terms, the majority of the aircraft would be produced in India. The deal envisions 12 to 18 jets delivered in ready-to-fly (fly-away) condition from France for rapid induction into service. The remaining jets would be manufactured domestically through a partnership involving Dassault Aviation (the French manufacturer) and Indian firms. Initial indigenous content is expected to start at around 30%, with potential to rise to 60% over time. This includes integration of Indian weapons, avionics, and systems, as well as the establishment of a Maintenance, Repair, and Overhaul (MRO) facility in India. Such localization efforts could also position India as a potential global hub for Rafale production and support in the future.

The urgency of this acquisition stems from the IAF's critical squadron shortage. The force currently operates only 36 Rafale jets, with 26 more naval variants (Rafale M) ordered last year. Overall, the IAF's fighter strength has depleted to around 28–29 squadrons, far below the sanctioned 42 and the ideal 60 required amid evolving regional threats. Experts highlight that the IAF faces a precarious situation, with further retirements of older fleets (like Jaguars, MiG-29s, and MiGs) looming in the coming decade, exacerbating the gap.

Defense analysts and former officers emphasize that the Rafale remains the most practical choice at present. It offers proven performance, high serviceability (claimed up to 90% in some assessments), and logistical continuity with the existing fleet. The aircraft performed exceptionally well in recent operations, providing operational familiarity. Alternatives like the American F-35 or Russian Su-57 present higher costs, geopolitical complexities, or integration challenges. While the deal represents a significant step toward addressing immediate needs, experts and veterans stress that it is not a complete solution—India must accelerate indigenous programs like the Advanced Medium Combat Aircraft (AMCA) for true long-term self-reliance and fifth-generation capabilities.

A retired Major General described the Rafale as the best immediate choice due to existing fleet integration (62 jets already or incoming), high serviceability, proven performance in operations, and logistical continuity. He noted alternatives like the F-35 (high cost and new ecosystem) or Su-57 (fifth-generation but integration issues) are less viable, but stressed the deal's modest initial indigenous content (30%) and delivery delays (starting 2030–2034) as concerns. He urged signing the contract swiftly to fill the current void, while emphasizing the need for fifth-generation aircraft to counter China's J-20 fleet (and potential exports to Pakistan).

However, a retired Wing Commander was more critical, arguing that no country shares strategic technologies freely—geopolitics dictates self-interest. He pointed out India's squadron strength has fallen dangerously low (potentially operating at 25 effective squadrons due to unserviceability), blaming short-sighted planning and inadequate R&D funding (currently ~0.7% of GDP).

He called for tripling investment to retain talent, fund indigenous projects like the Advanced Medium Combat Aircraft (AMCA) and next-generation programs, and avoid relying on foreign gifts. While acknowledging the Rafale as a necessary stopgap for deterrence and logistics, he warned it won't fully address China's system-centric warfare, standoff capabilities, or emerging stealth threats, labelling the IAF as still "platform-centric" and vulnerable.

Defence analyst highlighted both the deal's strengths and limitations. He described the Rafale as the best immediate choice due to existing fleet integration (62 jets already or incoming), high serviceability, proven performance in operations, and logistical continuity. He noted alternatives like the F-35 (high cost and new ecosystem) or Su-57 (fifth-generation but integration issues) are less viable, but stressed the deal's modest initial indigenous content (30%) and delivery delays (starting 2030–2034) as concerns. He urged signing the contract swiftly to fill the current void, while emphasizing the need for fifth-generation aircraft to counter China's J-20 fleet (and potential exports to Pakistan).

Another retired IAF officer emphasized the precarious timeline, projecting loss of 12 squadrons (Jaguars, MiG-29s, etc.) by 2035, with replacements like Tejas Mk-1A insufficient. He advocated buying off-the-shelf first and indigenizing later, warning against delays in "hangar hangover" for full localization—tools, rotables, and calibration equipment are complex to replicate domestically. He urged quick contract signing, even with higher French content initially, to avoid operational gaps, as squadrons often operate below authorized 18 aircraft with ~60% serviceability yielding just 8–12 ready jets per unit in wartime.

Overall, the opinion expressed viewed the deal as a mixed but necessary step—a stopgap to arrest squadron decline and leverage proven 4.5-generation capability while advancing self-reliance. It would elevate India's Rafale fleet to ~176 aircraft (largest outside France), but experts unanimously called for accelerated indigenous fifth-generation and unmanned programs to meet evolving threats from China, Pakistan, and beyond. If finalized, this mega-acquisition could reshape India's defence posture, balancing immediate deterrence with long-term industrial ambitions.