India emerges as first mkt to recover from tariff chaos

16-04-2025 12:00:00 AM

US reciprocal tariff pause improves mkt sentiment

- Investors’ wealth soars by `18.42 lakh cr

- Sensex climbs 1,578 pts, Nifty 500 pts

- FIIs buy equities worth Rs 6,065 cr

- Sensex recovers all losses since reciprocal tariffs announcement

- Auto stocks rally as Trump considers pausing tariffs on sector

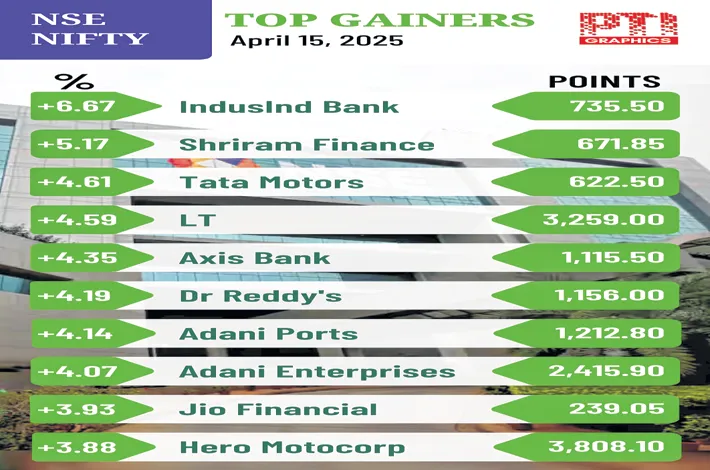

Key indices Sensex and Nifty climbed over 2% on Tuesday, followed by a rally in world markets after the US President relaxed some of the tariffs on electronics products, and hinted at a revision of tariffs on automobiles.

In general, the two indices have recovered all the losses induced by the US reciprocal tariffs announced on April 2.

Reflecting the uptrend, the 30-share BSE Sensex jumped 1,577.63 points to settle at 76,734.89. The NSE Nifty surged 500 points to 23,328.55.

Investors’ wealth grew by Rs 18.42 lakh crore in two days of sharp market rally. The market capitalisation of BSE-listed companies increased to $ 4.81 trillion in two days.

FIIs bought equities worth Rs 6,065 crore on Tuesday.

“The rally is fuelled by the surprise pause in reciprocal tariffs, led by the exemption on electronics goods. Market performance was broad-based, with sectors like financials, capital goods, realty and metals exhibiting optimism. Auto stocks gained on potential tariff relief and banking stocks benefited from deposit rate cuts. However, investors remain watchful considering future supply chain impact due to escalated tariffs on China and products such as steel and cars. Domestically, the focus has shifted to the earnings season which has a weak forecast while global recovery and RBI’s accommodative stance are supporting sentiment,” Vinod Nair, Head of Research, Geojit Investments, said.

“S&P 500 is up by 9% from the April lows, on the tariff pause. Since Nifty is up only 3% from the April lows, we had some catching up to do. This catching up, and some short-covering kept the market strong for the day. But investors have to understand that the uncertainty triggered by tariffs is very much alive, and, perhaps, more uncertainty is likely to come with sectoral tariffs, which Trump has declared are going to come,” said Dr VK Vijayakumar, Chief Investment Strategist, Geojit Investments.

“The Indian pharmaceutical sector may again come under pressure from Trump’s renewed tariff threat. Even though the bond market has reined in Trump who was on a rampage, he is unlikely to backtrack on tariffs. The current heightened uncertainty and potential volatility, it would be better for investors to focus on strong domestic consumption sectors such as financials, telecom, aviation, hotels, hospitals, and selectively on auto scrips,” he added.