Investor sentiment remains upbeat despite profit-booking

17-05-2025 12:00:00 AM

STOCKS | Sustained momentum in mid, small-cap stocks on FII buying

FPJ news Service mumbai

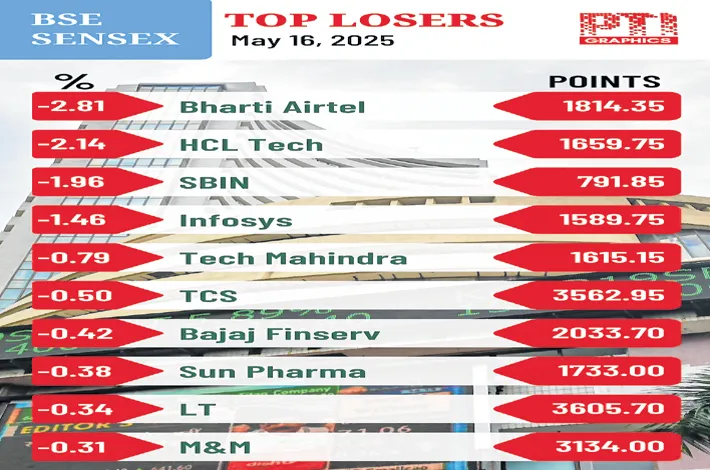

Investor sentiment remained upbeat on Friday despite mild and selective profit-booking. Selling pressure was at moderate levels from retail investors at IT, metal, banking and Bharti Airtel shares. The 30-share BSE Sensex fell 200.15 points to settle at 82,330.59. During the day, it lost 383.79 points to 82,146.95. The NSE Nifty lost 42.30 points at 25,019.80.

Bharti Airtel dropped by 2.81% after Singtel sold about 1.2% of its direct stake in the firm for around $1.5 billion. The stock dropped 2.81% to Rs 1,814.35 on the BSE. During the day, it dived 3% to Rs 1,810.10. At the NSE, the company’s stock declined 2.82% to Rs 1,814.40. The stock emerged as the biggest laggard among the Sensex and Nifty firms. The company’s market valuation eroded Rs 1.03 lakh crore to Rs 10.34 lakh crore.

FIIs bought equities worth Rs 8,831.05 crore. IndusInd Bank ended flat after dropping nearly 6% earlier in the day as the firm said its internal audit department found “unsubstantiated balances” of Rs 595 crore in “other assets” of its balance sheet, and has also examined the roles of key employees in this lapse.

The scrip lost 5.68% to Rs 735.95 during the morning trade on the BSE. Later, at the fag-end of the trade, the stock managed to close in the green, at Rs 782.30. At the NSE, shares of the bank ended at Rs 784.70, after dropping 3.90% to Rs 750 in morning trade.

“The market witnessed mild profit booking following a sharp rally in the previous session. Despite this, investor sentiment remained upbeat, with sustained momentum in mid- and small-cap stocks, as well as rate-sensitive sectors such as real estate, NBFCs, automobiles, and consumer durables. Defence stocks continued their upward trajectory, supported by a strong sectoral outlook.

Optimism is being fuelled by expectations of imminent resolutions in US-China and India-US trade relations, which are easing concerns over potential economic fallout. Additionally, softening crude oil prices, moderating inflation, and growing anticipation of interest rate cuts are reinforcing confidence in the economic growth outlook, driving a broad-based market resurgence. Institutional flows remain robust, with both FIIs and DIIs contributing to market stability and resilience,” said Vinod Nair, Head of Research at Geojit Investments.

“When aggressive market activity happens against the near consensus view, the market movement can be sharp. The near consensus view was that FIIs will slowdown purchases in India, and might even turn sellers preferring the cheaper Chinese stocks in view of the emerging US-China trade deal.

This explains the sharp rise in cash holdings of the mutual funds and DIIs turning sellers. But the FIIs’ aggressive contrarian move against the prevailing consensus by buying stocks for Rs 5,393 crore surprised the majority of market participants,” said Dr VK Vijayakumar, Chief Investment Strategist at Geojit Investments.