Markets cautious as Israel attacks Iran’s nuclear sites

14-06-2025 12:00:00 AM

POINTS TO PONDER

- Iranian retaliation to hit oil sensitive sectors

- Mcap of BSE listed companies erodes Rs 8.35 lakh cr to over Rs 447 lakh cr

- ONGC, Oil India may remain resilient despite oil price hike

- Gold demand remains strong, reflecting a shift to safe-haven assets; Brent crude up 8.8% at $75.48 in London; West Texas Intermediate climbs 9% to $74.15

Palazhi Ashok Kumar mumbai

Investor sentiment at Dalal Street remained cautious, and key indices continued their declining trend on Friday as Israel launched strikes across Iran, targeting Iran’s nuclear sites. Rising crude prices have further made investors adopt a wait and watch policy.

Oil prices will continue to rise if Iran in retaliation closes the Strait of Hormuz severely restricting oil supply. The marketcap of listed companies on BSE decreased by more than Rs 8.35 lakh crore to over Rs 447 lakh crore.

Oil prices surged on Friday after Israel’s air strikes, threatening supplies across the region, and sparked a rush to haven assets. Brent crude, the international benchmark, was up 8.8% at $75.48 in London after earlier spiking of more than 12%. West Texas Intermediate, the US benchmark, climbed 9% to $74.15. Adopt a de-risk strategy. Investors should go global. Sometimes bad news come in a flood.

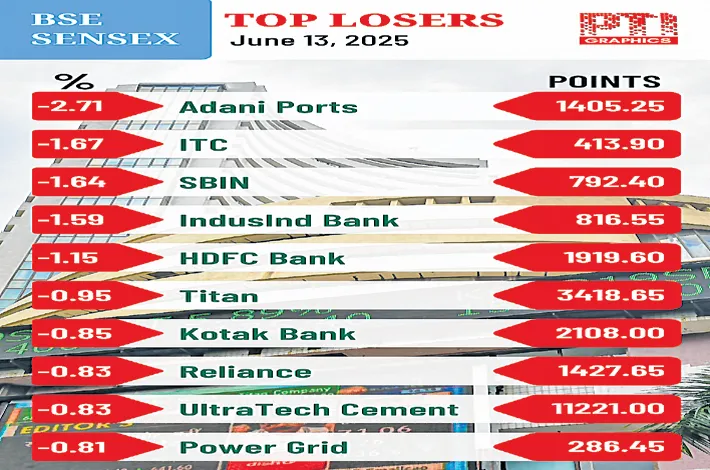

Close on the heels of the Ahmedabad air tragedy has come the news of Israel-Iran conflict. The 30-share BSE Sensex declined 573.38 points to close at 81,118.60. The 50-share NSE Nifty fell 69.60 points at 24,718.6. Crude oil sensitive sectors such as oil marketing companies, aviation, paints, adhesives and tyres recorded heavy losses. “The plunge in stock prices after President Trump announced his full slate of tariffs in early April briefly met the definition of a bear market. The S&P 500 fell just under 20% from its high, and the Nasdaq dropped 23%.

However, with the US and its trading partners stepping back from the tariff brink and the risk of recession easing, stocks have fully recovered and may now be poised for further gains over the next 12 months,” says Peter Oppenheimer, Goldman Sachs Research’s chief global equity strategist. According to Dr V K Vijayakumar, chief investment strategist at Geojit Investments, the Iran-Israel conflict’s impact will depend on how long the conflict lingers.

In the near-term the market will be in a risk-off mode. Oil producers like ONGC and Oil India will remain resilient. “FII fund outflows continue, and heightened geopolitical tensions impact market sentiment. Although India’s headline inflation for May eased to 2.8%, external headwinds overshadowed it. Gold demand remains strong, reflecting a shift to safe-haven assets,” said Vinod Nair, head of research at Geojit.