Markets cautious, Trump’s China trade truce in focus

13-08-2025 12:00:00 AM

The market will now focus on the outcome of the Trump-Putin talks scheduled for August 15

FPJ News Service mumbai

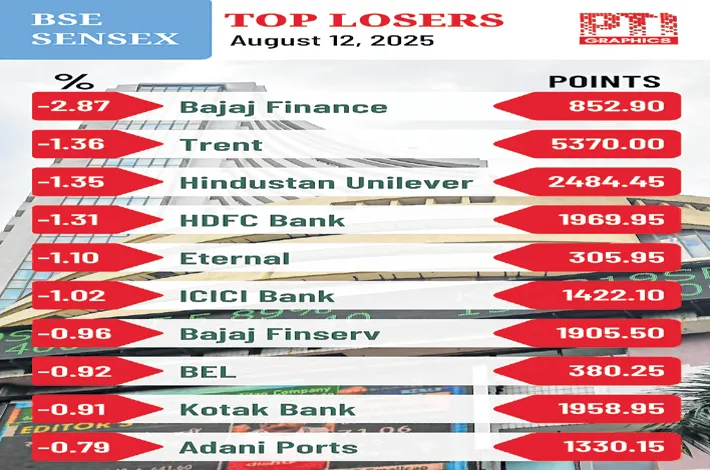

Indian markets reacted with volatility to the ongoing developments in global trade tariffs, reflecting caution following the extension of the US–China tariff truce. The US and China have extended their trade truce for another 90 days, just hours before the two biggest economies were set to raise tariffs on each other. The 30-share BSE Sensex lost 368.49 points to close at 80,235.59. The 50-share NSE Nifty closed 97.65 points lower at 24,487.40.

According to Dr VK Vijayakumar, chief investment strategist at Geojit Investments, the market will be focused on the outcome of the Trump-Putin talks scheduled for August 15. If the talks result in a breakthrough and a possible end to the Russia-Ukraine war, there will be a dramatic change in market sentiments.

“The 25% penal tariffs imposed on India for buying oil from Russia will become irrelevant. But since Trump has a bloated ego and he is unhappy with India’s response, we don’t know how things are going to pan out. Extension of the China-US talks for another 90 days is a reflection of the Chinese leverage in talks, particularly the leverage arising out of China’s dominant position in the rare earth magnet market.

“The robust equity fund flows of more than Rs 42,700 crore in July into mutual funds reflect the optimism of retail investors. This huge liquidity can support markets despite geopolitical headwinds. However, investors should be guarded against the elevated valuations in the broader market, particularly in smallcaps. Investors should focus on high quality fairly-valued growth stocks in financials, telecom and capital goods. Midcap IT offers value buying opportunities,” Dr VKV added.