Mkts rally on resilient macros, investor wealth rises `7.85L cr

12-04-2025 12:00:00 AM

- Sensex jumps 1,310 pts; Nifty surges 429 pts

- Investors cautious on Trump’s “tariffs on, tariffs off” approach

- The 90-day tariff pause delays proposed trade deals worth trillions of dollars

FP News Service mumbai

Though there is no room for a sustained rally in the present uncertain environment, pivotals rallied on Friday as investors took a relief from the fact that Indian macros are resilient, and India is one of the least impacted countries in the current global trade war.

The suspension of additional tariffs on India by the US for 90 days until July 9 has also boosted the market trend. “True, President Trump has paused some of the pains, but not the turmoil. The 90-day tariff pause, in fact, will only escalate trade chaos, as many proposed investment and trade deals remain uncertain, and delay in decision-making will further erode investor-confidence. His “tariffs on and tariffs off” approach, and China’s Friday retaliation (by raising its additional tariffs on imports from the US to 125% to the Trump’s 145% levies on Chinese exports), continue to hit the market sentiment, the world over,” said marketmen.

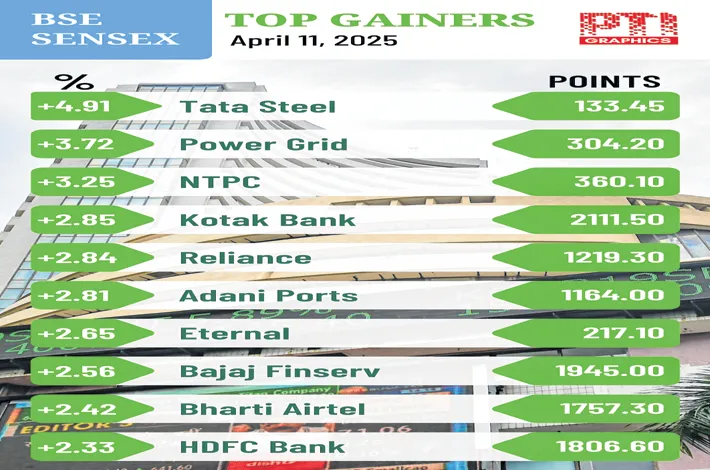

Investors’ wealth surged by Rs 7.85 lakh crore on Friday following the sharp rally. The aggregate market capitalisation of BSE-listed companies touched Rs $4.66 trillion. Despite a bearish trend in world markets, the 30-share BSE Sensex jumped 1,310.11 points to settle at 75,157.26. The NSE Nifty surged 429.40 points to 22,828.55. In intra-day trade, Nifty rallied 2.34% to 22,923.90. From the Sensex pack, Tata Steel, Power Grid, NTPC, Kotak Mahindra Bank, Reliance Industries and Adani Ports were among the top biggest gainers.

“The gap up opening in the Nifty is unlikely to sustain beyond a point given the elevated uncertainty in global markets. President Trump’s retreat from the reciprocal tariffs imposed on countries except China, was forced by the US bond market where instead of safe-haven buying in US treasuries, there was big selling, pushing the 10-year bond yield up to 4.5%. In brief, bond vigilantes forced Donald Trump to retreat.

The 10-year yield is even now at around 4.46%. The dollar index has fallen to 100,” said Dr VK Vijayakumar, Chief Investment Strategist, Geojit Investments. “There is no room for a sustained rally in the present uncertain context. Investors have to be cautious, and should prioritise safety over returns. Safety now is in fairly-valued largecaps,” Dr V K V recommended.

“An unexpected pause on reciprocal tariffs by the US provided relief in the midst of uncertainties. Though the IT major’s result missed the street estimates, it opines optimism in the latter half of FY26 owing to growth in the order book. Any development in the bilateral trade negotiations can alter the near-term outlook on the export-driven sectors,” Vinod Nair, Head of Research, Geojit Investments, said.