Mkts tumble; India-Pak conflict causes jitters

10-05-2025 12:00:00 AM

‘FY2026 will define India’s trajectory for centuries to come. We are proud of the story of “Sudarshan Chakra”, and the current conflict will end peacefully’

FPJ News Service mumbai

The escalating tensions between India and Pakistan caused jitters on Friday in Indian markets for the second consecutive trading session. Investors’ wealth eroded by Rs 7 lakh crore in two days as stock markets became jittery following the escalation of the India-Pakistan conflict. The market capitalisation of BSE-listed companies lost Rs 7.09 lakh crore to Rs 4,16,40,850.46 crore in two days.

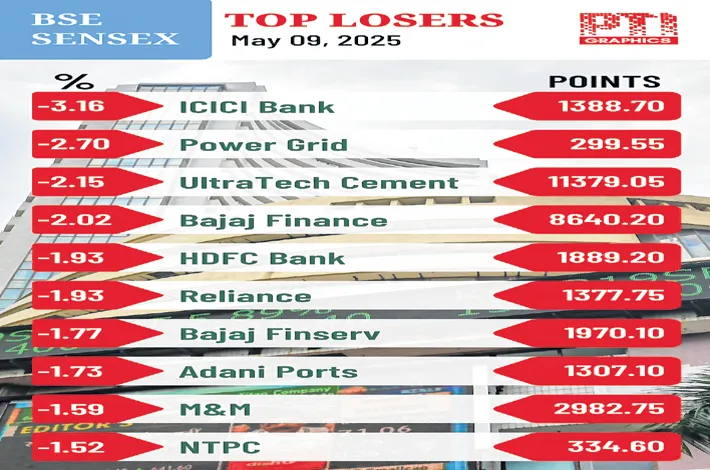

Indices extended their previous day’s downward trajectory with the BSE Sensex falling 880.34 points to settle at 79,454.47 and NSE Nifty losing 265.80 points at 24,008.

Nevertheless, the economic undercurrent remains resilient. Deriving the words of PM Narendra Modi, market gurus said, “This decade, indeed, will define India’s trajectory for centuries to come. The spirit of transformation is evident in every citizen, institution, and sectors across the country. We are proud of the story of the S-400 air defence system, called Sudarshan Chakra, and the current conflict will end peacefully.”

“A conflict was anticipated but the market was not expecting the situation to intensify, raising concerns about its duration. However, it is still projected to be a short-lived confrontation, given the strategic advantage and the opponent’s weak economic standing. Interestingly, FIIs continued to invest in the Indian market until Thursday, while retail investors remain slightly cautious at the moment,” said Vinod Nair, Head of Research, Geojit Investments.

Defense stocks surged on Friday morning trade as India swiftly thwarted Pakistan's fresh attempts to strike military sites with drones and missiles, including in Jammu and Pathankot, after foiling similar bids at 15 places in northern and western regions of the country, as tensions soared between the two countries amid fears of a wider conflict.

“Under normal circumstances, on a day like this, the market would have suffered deep cuts. But this is unlikely due to two reasons. One, the conflict, so far, has demonstrated India’s clear superiority in conventional warfare, and therefore, further escalation of the conflict will inflict huge damage to Pakistan. Two, the market is inherently resilient supported by global and domestic macros.

Weak dollar and potentially weakening US and Chinese economies are good for the Indian market. The domestic macro construct is further rendered stronger by the high GDP growth expected this year and the declining interest rate environment. These are the reasons why FIIs have been on a buying spree in the Indian market during the last sixteen trading sessions. Investors should not panic and exit from the market now. Remain invested, monitor the developments and wait for the dust to settle,” Dr VK Vijayakumar, Chief Investment Strategist, Geojit Investments.