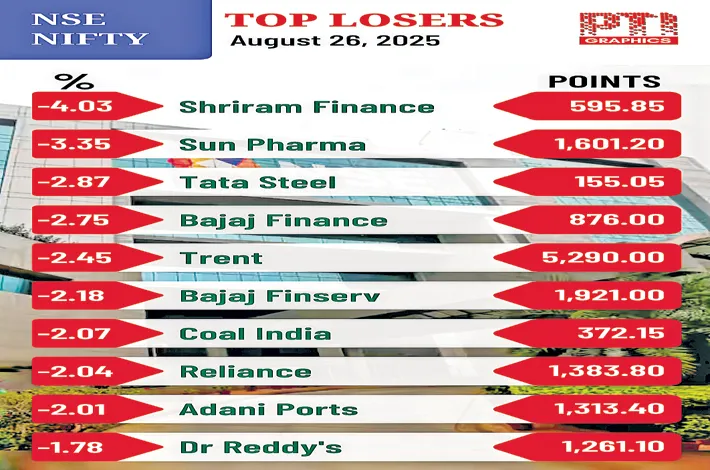

Sensex below 81,000; Trump’s 50% tariff bomb hits sentiment

27-08-2025 12:00:00 AM

FPJ News Service MUMBAI

Key index Sensex nosedived 849 points to slip below the 81,000 level on Tuesday due to widespread selling pressure after the US issued a draft notice over the implementation of an additional 25% tariff on Indian products.

Persistent FII fund outflows, and a weak global trend also dampened investor-sentiment. The 30-share BSE Sensex tumbled 849.37 points to close at 80,786.54. During the day, the index fell 949.93 points, to hit a low of 80,685.98. The 50-share NSE Nifty dropped 255.70 points to settle at 24,712.05. In the intra-day session, it dived 278.15 points to hit a low of 24,689.60.

The US has issued a draft order implementing an additional 25% tariff on Indian products, which President Donald Trump announced earlier this month, beginning today (August 27). “Domestic market sentiment turned cautious as the US penalty tariff deadline expires. The persistent depreciation of the INR is adding pressure and may further impact foreign institutional inflows. Investors are closely monitoring the government’s efforts to support economic growth, including proposed GST rate revisions and sector-specific relief measures for industries affected by higher tariffs. Broad-based selling was observed across sectors, except for FMCG, which gained on expectations of increased consumption,” said Vinod Nair, head of research at Geojit Investments.

“Resilient market co-existing with tepid earnings growth has made India the most expensive market in the world. Consequently FIIs have been sustained sellers; but massive DII buying totally eclipsing FII selling is supporting the market even amidst strong headwinds.