“Unknown unknowns”weigh on mkt sentiment

01-05-2025 12:00:00 AM

PTI New Delhi

Reduced reciprocal tariff risks, a potential India-US bilateral trade deal, and persistent foreign fund inflows were expected to trigger a fresh market momentum on Wednesday. However, escalating tensions between India and Pakistan capped a market rally.

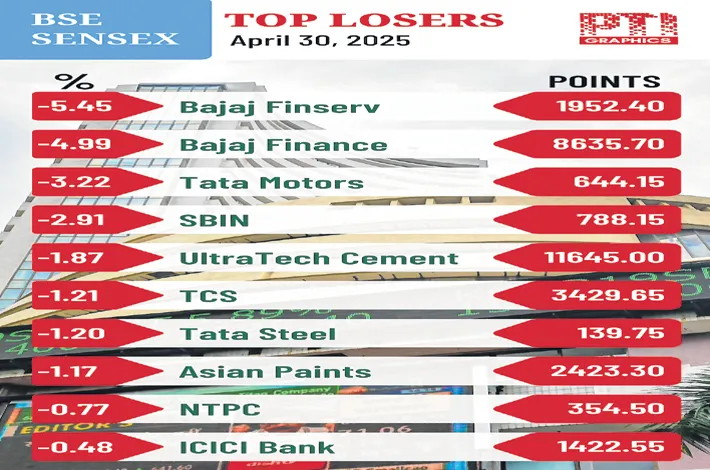

Benchmark indices Sensex and Nifty stayed range-bound for the second consecutive session, and settled flat in a highly volatile trade amid geopolitical tensions. The 30-share BSE Sensex declined 46.14 points to settle at 80,242.24. The NSE Nifty ended marginally lower by 1.75 points at 24,334.20.

“Markets often face unknown unknowns, as the most challenging circumstances such as the current geopolitical tensions, and the story of global economic uncertainties triggered by tariffs,” opined marketmen.

“The broad market performed well in April, driven by reduced tariff risks, a potential US-India trade deal, and strong FII inflows. However, momentum is being capped by rising geopolitical tensions and muted Q4 results. This negative bias is expected to persist in the near term, but the long-term outlook remains positive due to the minimal financial impact from the conflict. Consequently, any market consolidation is likely to be used as an investment opportunity,” said Vinod Nair, Head of Research, Geojit Investments.

“There are unknown unknowns in the market now. The surprising resilience of the market is significant. After the reciprocal tariff tantrums and the heightened tensions between India and Pakistan, Nifty is up 5% in April. This underscores the importance of not panicking during a crisis. It is important to remain invested. The crucial support to the market is coming from the sustained FII inflows which have touched a cumulative figure of Rs 37,325 crores in the last 10 trading sessions,” said Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments.