Banks hoarding funds, prefer to park with RBI

29-07-2025 12:00:00 AM

NIM will take a hit if bks fail to lend surplus funds effectively

If banks don’t start lending more confidently, the next rate cut might look “good on paper”, and do “very little” in practice

Banks are hoarding funds, but preferring to park them with the Reserve Bank rather than take fresh credit risks. In real terms, banks are more concerned about the potential higher NPAs in priority sector lending. “The RBI is threading a needle. Its key objective is to support growth, but on its terms. Durable liquidity has been injected through CRR (Cash Reserve Ratio) relief. Short-term distortions are being managed through VRRR (Variable Rate Reverse Repo). But the market’s real issue is lack of risk appetite, and is something monetary policy alone may not fix,” banking gurus said.

“Despite the liquidity flush, loan growth remains subdued. Scarcity of funds is not the reason for the sluggish credit off-take. Banks are more concerned about NPAs, and if banks don’t start lending more confidently, the next rate cut might look good on paper but do very little in practice,” R Madhusoodanan, a senior former SBI official and a financial expert, told The Free Press Journal. “Unless banks effectively use the surplus funds available for lending purposes rather than keeping in, their Net Interest Margin is going to take a hit. Therefore, it is high time for banks to re-work their strategies to augment credit flow to various sectors and help the nation achieve the targeted GDP,” Madhusoodanan, pointed out.

As of July 2025, the banking system’s surplus liquidity is hovering around Rs 2.5 to Rs 3 lakh crore on average, with peaks exceeding Rs 9 lakh crore. It’s a sign of cash not being deployed. To manage the overflow, the RBI has stepped up its VRRR operations starting with daily auctions, now moving to multi-day and even record-volume draws. On July 4, Rs 1.71 lakh crore was absorbed in a single day, against a notified Rs 85,000 crore. It’s not just excess liquidity, as banks say, “We’d rather lend to the RBI than to the market.”

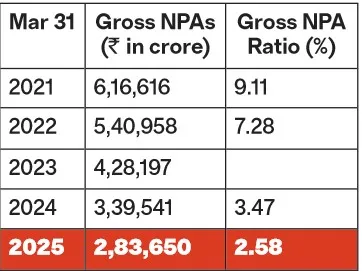

Bank credit growth has been falling sharply in the current year despite a fall in GNPA and GNPA ratio. On July 22, the Ministry of Finance said the NPAs ratio has been reduced from 9.11% in 2021 to 2.58% in 2025. Official statistics released (July 25) revealed that the total bank credit grew below 10% (9.8% y-o-y) as on July 11, 2025 at Rs 184.63 lakh crore. It showed a fall of over Rs 23,000 crore during the fortnight. The y-o-y credit growth was 14% during the same period in the previous year. During the period under review, total bank deposits stood at Rs 233.25 lakh crore, and during the fortnight, deposits fell by over Rs 99,000 crore.