Broad-based sell-off across IT, fin sectors

19-07-2025 12:00:00 AM

FPJ News Service mumbai

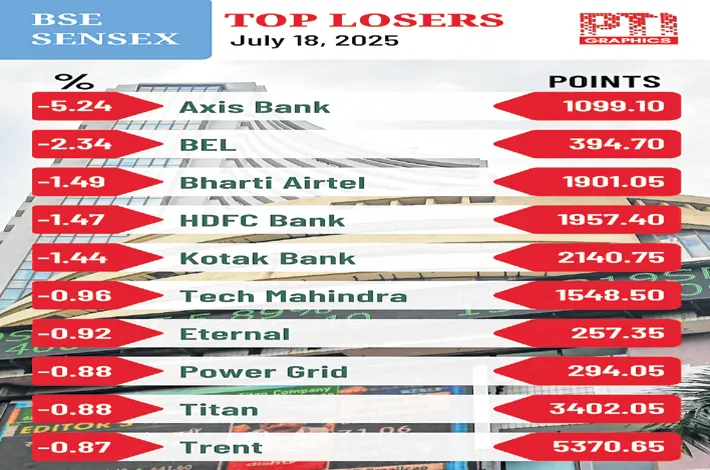

Key indices Sensex and Nifty continued their declining trend on Friday as IT and finance sector stocks witnessed broad-based selling pressure. The 30-share BSE Sensex tanked 501.51 points to settle at 81,757.73. During the day, it shed 651.11 points to hit a low of 81,608.13. The 50-share NSE Nifty dropped 143.05 points to close at 24,968.40.

“A broad-based sell-off was observed amidst a disappointing initial set of earnings from the finance and IT sectors. Elevated valuations in large-cap stocks, coupled with significant net short positions held by FIIs, have contributed to a cautious sentiment among investors.

“Additional tariff threats are also casting a shadow on India over its trade relationship with Russia. Despite these pressures, the medium-to-long-term outlook for India remains optimistic, supported by low inflation levels and proactive monetary authority committed to sustaining economic growth,” said Vinod Nair, head of research at Geojit Investments.

Shares of Axis Bank closed over 5% lower after the company reported a 3% dip in June quarter consolidated net profit. The stock tanked 5.24% to close at Rs 1,099.10 on the BSE. During the day, it dropped 7.40% to Rs 1,073.95. At the NSE, the stock dived 5.26% to Rs 1,098.70. Intra-day, it tumbled 6.36% to Rs 1,086 apiece. The stock emerged the biggest laggard among the Sensex and Nifty firms. However, shares of IT services firm Wipro closed nearly 3% higher after it posted a 9.8% increase in consolidated net profit during the April-June quarter. The stock rallied 4.43% to Rs 271.80 in intra-day trade on the BSE. The stock finally ended at Rs 266.90, up 2.56%.

“In July, so far, India has been underperforming most markets, with a dip of 1.6% in Nifty. A significant contributor to the decline is the selling by FIIs. There is a clear pattern in FII activity this year so far. They were sellers in the first three months. For the next three months they turned buyers. The trend so far indicates further selling unless some positive news reverses the downtrend,” Dr VK Vijayakumar, chief investment strategist at Geojit Investments, said.