Delay in Indo-US trade negotiations likely: Investors

24-10-2025 12:00:00 AM

FPJ News Service mumbai

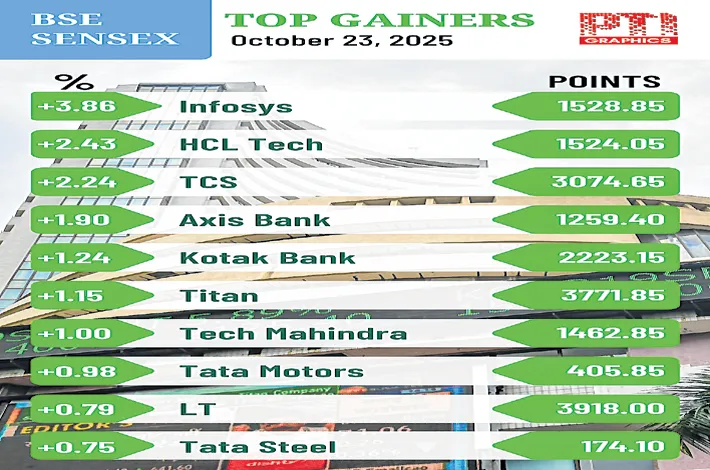

The domestic stock markets opened on a positive note on Thursday amid US sanctions on Russian oil and the potential postponement of India–US trade negotiations. Equities, however, lost early gains as institutional and individual investors resorted to profit-booking. The 30-share BSE Sensex climbed 130.06 points to settle at 84,556.40. The 50-share NSE Nifty settled 22.80 points higher at 25,891.40.

Trump announced new sanctions targeting Russia’s two oil companies in an effort to pressure Moscow to negotiate a peace deal in Ukraine. “Every time I speak to Vladimir, I have good conversations and then they don’t go anywhere,” Trump said.

Trump’s words, in fact, were interpreted cautiously by Indian investors. High net worth individual investors ask: “Will this be the story of India-US trade negotiations?" Investors in general fear postponement of India–US trade negotiations. It is unlikely that PM Modi will attend the ASEAN summit in Kuala Lumpur this week, putting an end to speculation over a possible meeting with President Trump.

On the contrary, there are also reports of an imminent interim trade deal between India and the US. Recent comments from Trump and responses from PM Modi indicated an early deal. “The expected deal involves some concessions from both sides. If the reported 15-16 % tariffs on Indian exports to US materialises that would be a big positive for the Indian economy, and a major boost to markets,” underlined veteran investment strategist Dr. VK Vijayakumar.

“IT stocks advanced as sentiment improved after Trump’s softer tone on H1B visas. FIIs are gradually returning to India, encouraged by expectations of better corporate earnings in H2FY26 supported by festive demand, tax benefits and GST reductions. As the undercurrent vibes of the domestic market have improved due to a possible India-US deal and a rise in consumer demand, the broad market is expected to do much better henceforth,” said Vinod Nair, head of research, Geojit Investments.