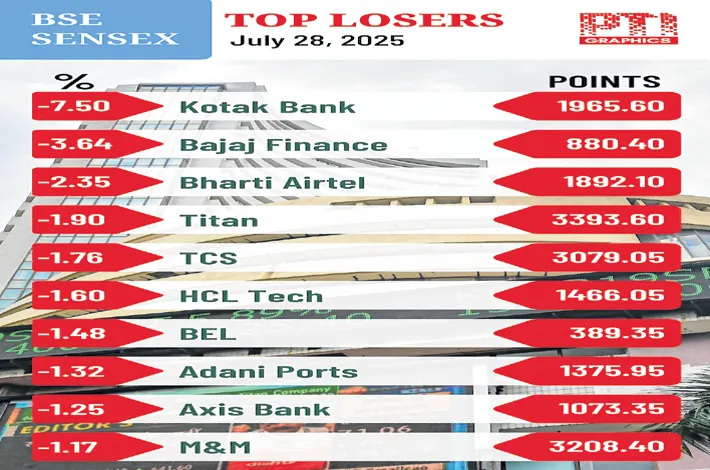

Disappointing quarter earnings, US-FTA delay hit investor sentiment

29-07-2025 12:00:00 AM

Investor sentiment remained cautious on Monday, weighed down by a disappointing set of first quarter earnings, delay in the much-awaited India-US interim trade deal, and continued FPI outflows.

The 30-share BSE barometer tanked 572.07 points to settle at 80,891.02, nearly a two-month low due to heavy selling in select bank scrips. During the day, it slumped 686.65 points to 80,776.44. The 50-share NSE Nifty declined 156.10 points to close at a nearly two-month low of 24,680.90.

“Domestic market sentiment has remained cautious, weighed down by a disappointing set of Q1 earnings, delays in the India-US trade agreement, and continued FII outflows. In contrast, global markets remain broadly positive, supported by US-EU trade developments that are perceived as less concerning than anticipated. The upcoming monetary policy decisions from the Fed and BoJ, along with the trajectory of domestic quarterly earnings, are expected to play a pivotal role in shaping market direction in the near term,” said Vinod Nair, head of research, Geojit Investments.

“While trade deals with Japan and EU, thought to be difficult initially, have happened, the much expected India-US trade deal is even now hanging fire. This has impacted market sentiments. The sharp cut in the IT index has been dragging the market down, and there is no respite in this in view of the 2% cut in its global workforce announced by TCS,” said veteran investment strategist Dr VK VIjayakumar.