GST cuts to ease burden on common man

04-09-2025 12:00:00 AM

metro india news I hyderabad

The 56th GST Council meeting began on Wednesday with a focus on overhauling the indirect tax system to boost domestic demand and counter economic challenges posed by rising US tariffs. Chaired by Union Finance Minister Nirmala Sitharaman, the Council discussed slashing GST rates on essential goods and simplifying the tax structure.

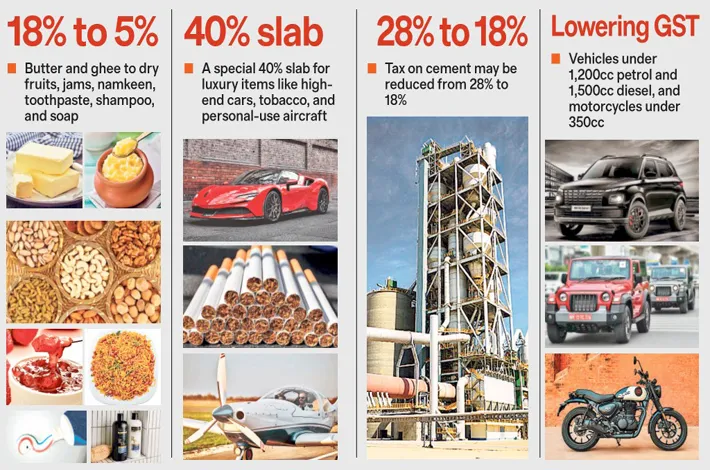

Sources said the government plans to cut GST on widely used items—from butter and ghee to dry fruits, jams, namkeen, toothpaste, shampoo, and soap—from 18% to 5%. Footwear and apparel priced up to ₹2,500 may also see rates drop from 12% to 5%, up from the earlier ₹1,000 threshold.The Council is also reviewing a shift from the current four GST slabs (5%, 12%, 18%, 28%) to a simplified two-rate structure (5% and 18%), with a special 40% slab for luxury items like high-end cars, tobacco, and personal-use aircraft.

The tax on cement may be reduced from 28% to 18%, while discussions are ongoing for lowering GST on vehicles under 1,200cc petrol and 1,500cc diesel, and motorcycles under 350cc.Meanwhile, items over ₹2,500, such as luxury garments and footwear, may move to the 18% slab. High-end vehicles and yachts could face 40% GST.

Eight opposition-ruled states, including Kerala, Tamil Nadu, and Telangana, demanded revenue compensation for potential losses. Jharkhand warned of a ₹2,000 crore revenue hit. However, Andhra Pradesh expressed support for the Centre’s proposals.Final decisions are expected Thursday.

Meanwhile, Telangana Deputy Chief Minister Bhatti Vikramarka Mallu highlighted the state's concerns over GST rate rationalization and its impact on finances. He explained that over 50% of Telangana’s revenue goes to salaries, pensions, and debt repayment, leaving little room for fiscal maneuvering. Any revenue decline could harm essential services like health, education, and welfare schemes, and delay infrastructure projects, hampering development.

Bhatti, along with senior officials, attended the 56th GST Council meeting chaired by Union Finance Minister Nirmala Sitharaman in New Delhi. The discussions centered on rate rationalization and compensation mechanisms.