India emerges as key battleground for obesity drugs

29-12-2025 12:00:00 AM

Lilly, Novo fight for India ahead of generics

India has emerged as the newest and fiercest marketing battleground for the global obesity drug industry. In 2025, pharmaceutical giants Eli Lilly of the United States and Novo Nordisk of Denmark are racing to capture India’s rapidly expanding market for weight-loss and diabetes medicines, ahead of the entry of significantly cheaper Indian-made alternatives expected in 2026.

At the centre of this race are Lilly’s Mounjaro (tirzepatide) and Novo Nordisk’s Wegovy and Ozempic (semaglutide). These drugs have transformed obesity treatment worldwide but come at a high cost. Both companies are working aggressively to secure doctors, patients and distribution networks before key patents expire in March 2026, which will open the door to low-cost generic versions.

India is projected to have the world’s second-largest overweight or obese population by 2050, making it a critical growth market for global drugmakers. Analysts estimate the global obesity drug market could reach $150 billion annually by the end of the decade. While the United States remains the largest consumer, India is emerging as a fast-growing market despite most patients paying out of pocket.

According to data analytics firm Pharmarack, India’s obesity drug market is currently valued at Rs 6.28 billion ($70.23 million), a fivefold increase since 2021. Early sales indicate strong momentum, particularly in metropolitan cities such as Hyderabad, Delhi, Mumbai and Bengaluru.

Lilly’s Mounjaro, approved in India for both diabetes and weight loss, surged ahead soon after its March 2025 launch. By October, it became India’s top-selling obesity therapy by value, with sales doubling within months and overtaking Novo’s Wegovy, which entered the market later in June.

Novo Nordisk, however, has responded swiftly, focusing on price adjustments, faster rollouts and wider access to maintain its market position before generics potentially slash prices by up to 60%. More than 20 Indian pharmaceutical companies, including Dr Reddy’s, Cipla, Sun Pharma, Zydus Lifesciences and Lupin, are preparing to launch cheaper alternatives once Novo’s patent expires.

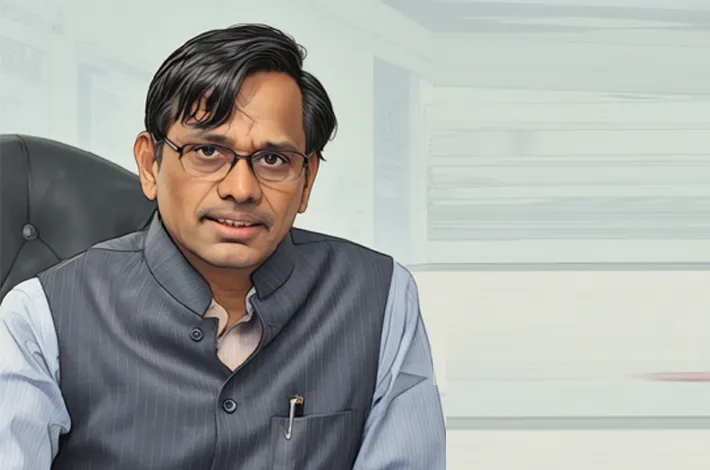

Doctors in Hyderabad report a sharp rise in demand over the past eight months. Dr E. Ravi Shanker, Consultant Endocrinologist at Apollo Hospitals, Jubilee Hills, said the use of these injections has become increasingly common. “Obesity and diabetes are on the rise in Hyderabad. These medications are invaluable tools,” he said.

He noted that five to six obese patients approach clinics daily specifically seeking weight-loss injections, while pre-diabetes cases are nearly double. However, he cautioned that the drugs are not suitable for all age groups, pointing to a worrying increase in obesity and diabetes among teenagers due to lifestyle habits.

Monthly obesity-related patient numbers in Hyderabad alone range between 250 and 300, with many opting for medication. As generic competition looms, Novo executives say the company will focus on quality, trust and affordability beyond patent protection.