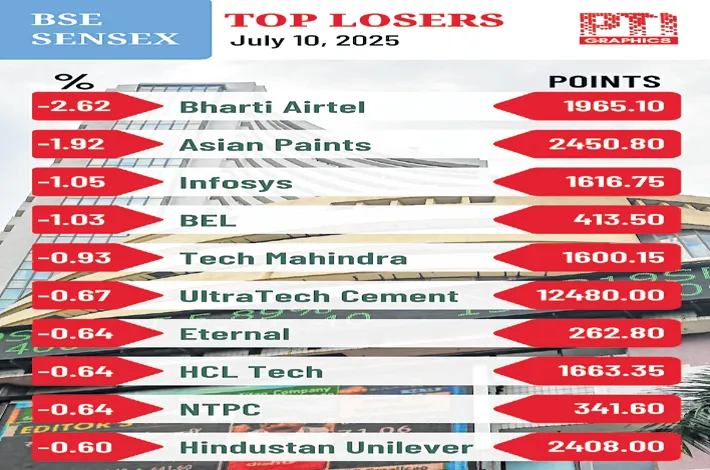

Investors cautious, mkts close in red

11-07-2025 12:00:00 AM

Investors remained cautious on forthcoming Q1 working results from blue-chip companies, and potential delay in India-US BTA

FPJ News Service mumbai

Indian equities closed in the red on the weekly expiry day on Thursday as investors remained cautious on forthcoming Q1 working results from blue-chip companies, and potential delay in India-US interim trade deal. There will be lots of stock-specific action in response to the working results. Midcap IT companies are expected to report encouraging results and promising outlook.

The 30-share BSE Sensex dropped 345.80 points to close at 83,190.28. During the day, it declined 401.11 points to 83,134.97. The 50-share NSE Nifty declined 120.85 points to 25,355.25. As far as Bank Nifty is concerned, Bajaj Broking Research said, the broader trend of Bank Nifty remains positive, and any dips should be viewed as buying opportunities.

“Banks, despite strong balance sheets and abundant liquidity, are struggling with low credit growth. Outperformers in the banking segment will be those who post good credit growth. In autos M&M and Eicher have the potential to outperform,” said Dr VK Vijayakumar, chief investment strategist at Geojit Investments.

“The mid-and-small-caps had limited negative action, reflecting a wait-and-watch approach amid rising expectation of a better earnings outlook compared to large caps,” said Vinod Nair, head of research, Geojit Investments. Resilience of the global markets and sustained fund flows into Indian markets have the potential to support the market at the bottom end of the range.