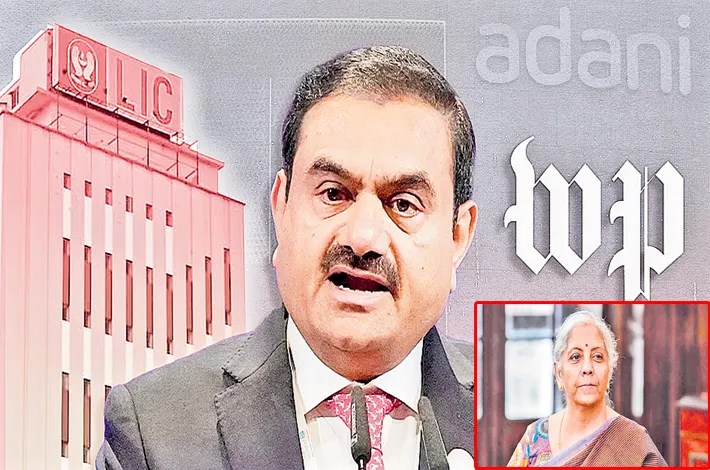

LIC refutes fund transfer to Adani group

04-12-2025 12:00:00 AM

The Life Insurance Corporation of India (LIC) has strongly refuted allegations published by The Washington Post that the Indian government pressured the state-owned insurer to channel funds into Adani Group companies at a time of heightened U.S. regulatory scrutiny and debt concerns. Finance Minister Nirmala Sitharaman categorically dismissed the charges in Parliament, asserting that LIC’s investment decisions are fully independent, governed by strict internal due diligence, multi-level audits, and oversight from the Insurance Regulatory and Development Authority of India (IRDAI).

The Washington Post alleged that in May 2025, Indian government officials from the Finance Ministry and Department of Financial Services drafted and fast-tracked a proposal to channel approximately $3.9 billion (Rs 32,000 crore) from state-owned Life Insurance Corporation of India (LIC) into Adani Group companies. Citing internal documents and interviews, the report claimed this was to signal confidence in the conglomerate, encourage other investors, and refinance its rising debt amid U.S. scrutiny, including a $265 million bribery indictment against Gautam Adani. LIC's bonds in Adani Ports and equity stakes were highlighted as risky yet pushed for higher yields.

Speaking on the floor of the house on Tuesday, Finance Minister Nirmala Sitharaman also highlighted that LIC’s exposure to the Adani Group remains less than 2% of the conglomerate’s total debt. Since 2017, LIC has invested around Rs 31,000 crore in Adani firms, with the current market value standing at approximately Rs 65,000 crore — a more than doubling of value. She noted that LIC invests across India’s top 500 listed companies, including Reliance, Tata, NTPC, L&T, ICICI, and SBI, with its equity portfolio growing tenfold in the last decade from Rs 1.5 lakh crore to Rs 15.5 lakh crore.

Insurance experts and senior officials emphasized that no investment is made without approval from LIC’s investment committee and thorough research, and any suggestion of direct ministerial interference contradicts both regulatory safeguards and the insurer’s documented processes. A former IRDAI member made it clear that exposure norms are strictly followed, external interference not permitted and that the total exposure to the Adani Group is relatively low.A specific point of contention was LIC’s reported Rs 5,000 crore subscription to a 15-year, 7.75% rupee-denominated non-convertible debenture issue by Adani Ports in May 2025.

Rated AAA by domestic agencies CRISIL and ICRA, the bond was described by the Managing Director of a corporate research firm as a “market-beating, triple-A rated, long-duration instrument” that perfectly matches LIC’s asset-liability requirements. He noted that global giants including BlackRock and major Japanese banks also participated in similar Adani debt issuances, underscoring that LIC was neither an outlier nor acting under duress. “From both LIC’s and Adani’s perspective, it was a win-win transaction,” he said.

Perception vs reality: The real battlefield

While markets showed little reaction—neither Adani nor LIC stocks moved significantly after the Washington Post report—experts warned of broader perceptual damage. Another financial and stock market advisor argued that in an era of geopolitical competition over economic reputation, India must counter speculation swiftly. He suggested IRDAI conduct a rapid, transparent inquiry into the specific transactions and publish findings to “cut off any scope for speculation.” A corporate alw expert reinforced that insurance companies operate under “extremely robust” standard operating procedures, investment committees, and regular IRDAI inspections, making ad-hoc or politically directed investments practically impossible.

A Question of deterrence

Also discussed about was the difficulty of legal recourse against overseas publishers. Both legal as well as financial experts agreed that without Indian court precedents on defamation in such cross-border cases, deterrence remains weak, allowing recurring “narrative attacks” on Indian institutions and corporates. The consensus was clear: LIC’s processes are watertight, its Adani exposure is fractional and compliant, and the investments align with both regulatory mandates and sound commercial logic. While discerning investors and markets have largely ignored the controversy, repeated perception-driven assaults risk eroding public confidence in institutions that safeguard the savings of millions of Indian households.