Market rally comes to a halt on profit-booking

27-03-2025 12:00:00 AM

FPJ News Service mumbai

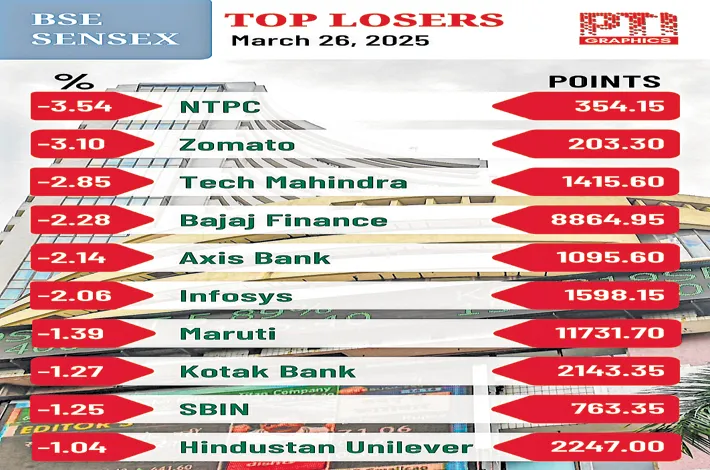

Markets experienced profit-booking on Wednesday after the recent rally with Sensex losing 728 points and Nifty 182 points. Despite the April 2 reciprocal tariff concerns the market had turned resilient almost for a week indicating further upside. Market men, however, hope that the reciprocal tariffs may be less stringent than feared.

“The market experienced profit-booking on the back of next week’s US tariff announcements. The sectors with higher exposure to the US market, like pharma and IT, have witnessed some selling pressure. Oil prices inched higher driven by US sanctions on Iran and anticipation of a drop in US crude inventories. With the onset of FIIs inflow, revival in domestic fundamentals and favourable valuation, the market is expected to trade with more stability,” Vinod Nair, head of research, Geojit Investments.

“A bilateral agreement between US and India is a likely scenario if the negotiations underway between the two countries lead to a positive outcome. The fundamental support to the market comes from India’s improving macros and the FIIs turning buyers. FIIs inflows stood at Rs 19,136 crore in the last four trading days indicating that the positive trend might continue. Consequently fairly valued high quality financials will continue to be resilient. If the reciprocal tariffs are not as severe as feared, pharmaceutical stocks will rebound smartly,” Dr VK Vijayakumar, Chief Investment Strategist, Geojit Investments.

“Participants are booking profits ahead of the March derivatives contract expiry, while concerns over tariff discussions continue to weigh on sentiment,” Ajit Mishra-SVP, Research, Religare Broking, said.On the dollar-rupee rates, Jateen Trivedi, VP Research Analyst-Commodity and Currency, LKP Securities, said, “Crude prices have seen positive momentum, contributing to rupee weakness, while profit booking in capital markets has added further pressure.”