Markets cautious ahead of GST Council meeting

03-09-2025 12:00:00 AM

FPJ News Service mumbai

Equities reversed early gains from strong macroeconomic data and closed lower on Tuesday on profit booking amid caution ahead of the GST Council meeting. The GST Council, which is the apex body that decides indirect tax rates, will meet today and tomorrow (Sept 3-4) to review and finalize the proposals. Profit-taking in heavyweight banking and financial counters exerted downward pressure.

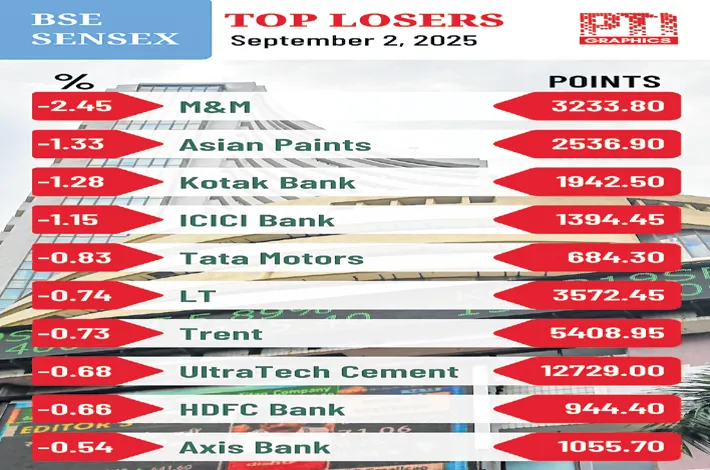

According to Bajaj Broking, indices closed lower in a volatile session, marking the first Tuesday expiry under the new weekly derivatives settlement cycle. The 30-share BSE Sensex declined 206.61 points to close at 80,157.88. The barometer opened higher and traded with gains till late afternoon session. However, profit-taking at the fag-end dragged the index down by 752.64 points from the day’s high of 80,761.14. The 50-share NSE Nifty dipped 45.45 points to 24,579.60. During the day, it hit a high of 24,756.10, and a low of 24,522.35.

“Domestic equities reversed early gains from strong macro data, ending lower on profit booking amid caution ahead of the GST Council meeting and F&O expiry, with banking stocks leading the decline. Sugar stocks rallied on relaxed ethanol norms, while export-oriented companies gained following dovish remarks by the US, renewing trade optimism. However, investors remain guarded, with a near-term focus on domestic consumption amid global uncertainty,” said Vinod Nair, head of research at Geojit Investments.

According to Dr VK Vijayakumar, chief investment strategist at Geojit Investments, global geopolitics and power equations are changing at a fast and furious pace. India-US relations have deteriorated and normalcy appears difficult in the near future. More actions from the unpredictable US administration are likely. The consequences on the Indian economy and markets cannot be ascertained now. Investors should wait and watch for developments to unfold. Meanwhile, investments can be focused on domestic consumption plays which are on sound footing. There are clear signs of the Indian economy bouncing back as reflected in the Q1 GDP numbers.