Mkts end flat; broader sentiment cautious

24-09-2025 12:00:00 AM

The domestic markets traded range bound and ended flat on Tuesday, indicating continuation of the consolidation. According to Dr VK Vijayakumar, Chief Investment Strategist at Geojit Investments, The major drag on the market since the 2024 September peak is the sustained FII selling, which, in turn, is being triggered by the high valuations in India and attractive valuations elsewhere.

FIIs sold equity worth Rs 1,21,210 crore in 2024 and this year (until September 22, 2025), FIIs have sold equities for Rs 1,79,200 crore through the exchanges. The high valuation differential between India and other markets have enabled the FIIs to move money from India to other markets and profit from it.

The scenario will change when India’s corporate earnings start improving. Indications of this uptrend in corporate earnings are expected to trickle in with the festival season. Already there are reports of a sharp spike in bookings for automobiles.

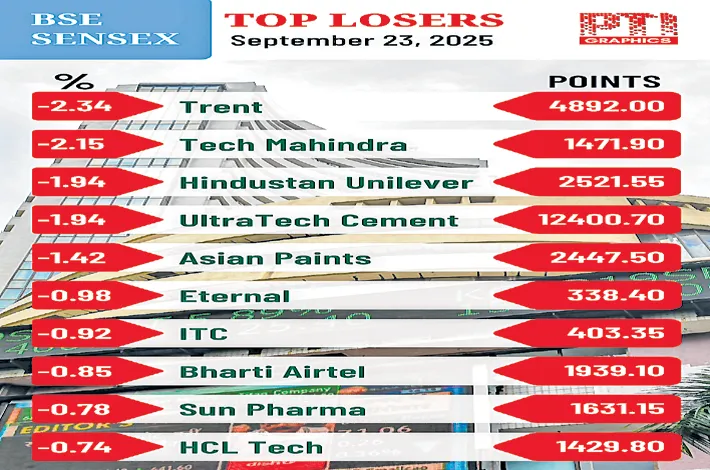

The BSE 30 Sensex lost 57.87 points to close at 82,102.10. Nifty declined 32.85 points at 25,169.50.

Auto shares climbed after automakers saw bumper sales on the first day of Navratri under the new GST regime.

“Broader sentiment stayed cautious, with small- and mid-cap stocks lagging the benchmarks. Sector-wise, autos, metals, and financials gained on signs of robust festive demand post-GST cuts, while FMCG and realty stocks came under pressure from profit booking. The rupee hit a record low amid persistent FII outflows, exacerbated by ongoing concerns over US tariffs and a widening trade deficit,” Vinod Nair, Head of Research at Geojit Investments, said.

IT stocks fall

IT stocks fell for the second day in a row on Tuesday, amid concerns over the steep hike in US H-1B visa fees. Hexaware Technologies lost 5%, Mphasis declined 2.58%, Mastek lost 2.40%, Tech Mahindra fell by 2.07%, HCL Tech declined 0.74%, TCS (0.38%), Wipro (0.26%) and Infosys (0.16%) on the BSE. The BSE IT index declined 0.63% to 34,769.38.