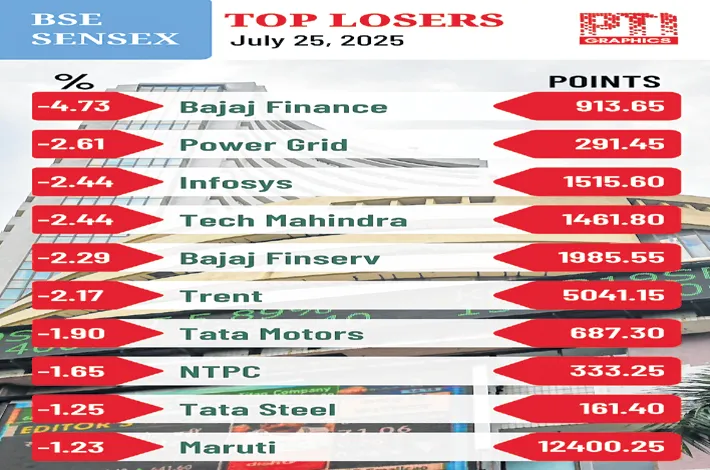

Mkts fall amid excessive valuations, FII selling

26-07-2025 12:00:00 AM

FPJ News Service mumbai

Subdued corporate earnings, excessive valuations, FII selling and lacklustre global signals triggered a broad-based sell-off across Indian equities on Friday. Investors' wealth eroded by Rs 8.67 lakh crore in two days of sharp fall, where the benchmark Sensex tanked 1.52%. The 30-share BSE Sensex lost 721.08 points on Friday to settle at over a month's low of 81,463.09. During the day, it plunged 786.48 points to 81,397.69. The 50-share NSE Nifty dropped 225.10 points to a month's low of 24,837.

“The near-term market construct has turned weak. Sustained FII selling of Rs 11,572 crore (from July 21 to 24) had a negative impact on the market. The weakness in the broader market, particularly in smallcaps, might continue since valuations had turned excessive and difficult to justify,” said Dr VK Vijayakumar, chief investment strategist, Geojit Investment.

“Subdued corporate results and lacklustre global cues triggered a broad-based sell-off across domestic equities. Elevated valuations in large-cap stocks, coupled with significant net short positions held by FIIs, added to the downward pressure.

“Investor sentiment remained fragile amid ongoing uncertainty over US-India tariff negotiations and the ECB maintaining the status quo, with rate cuts deferred until clearer insights emerged on the inflationary impact of trade developments,” Vinod Nair, Head of Research, Geojit Investments Limited. “The India-UK FTA, which is India’s first comprehensive trade agreement with a major developed country, has two implications from the market perspective.

One, this deal will significantly boost trade between both countries, which will be seen as a positive by the market. “Two, this pact projects India as a nation committed to free trade. Textiles, leather, food processing, automobiles, pharmaceuticals and gems and jewellery are expected to benefit from the India-UK CETA, will be on the market radar,” Dr VKV added.