Mkts fall amid fears of ‘substantial’ tariffs

06-08-2025 12:00:00 AM

FPJ News Service mumbai

Markets fell on Tuesday ahead of the Reserve Bank’s monetary policy decisions on Aug 6, and rising concerns over President Trump’s statement that he would be raising tariffs on India within 24 hours.

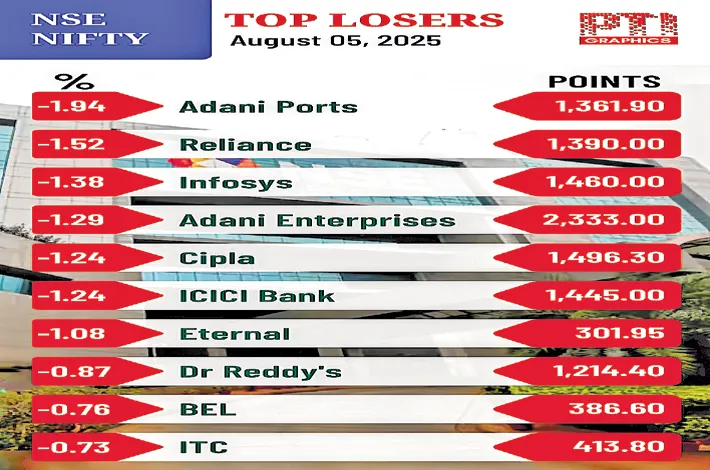

Oil and gas stocks led the market decline amid concerns about future import restrictions on Russian oil. The 30-share BSE Sensex fell by 308.47 points to close at 80,710.25. During the day, it declined 464.32 points to hit an intraday low of 80,554.40. The broader NSE Nifty fell 73.20 points to close at 24,649.55. In the intraday session, it slipped by 132.45 points to 24,590.30.

“Despite positive global cues, domestic markets remained range-bound in negative territory. Weakness persisted on Pharma and IT stocks which are among the largest exporters to the US. Sentiment was also weighed by INR depreciation. In contrast, auto stocks continue to gain traction from July volumes. Investors are now awaiting the upcoming RBI policy decision, where the market has marginal expectations of a rate cut, in the near-term. Currently, the preferences of investors are for domestic consumption-driven stocks and sectors holding limited volatility to external factors,” said Vinod Nair, head of research, Geojit Investments.

“The statement from Trump is a big threat. If he walks his talk, the India-US relations will further strain and the impact on India’s exports to the US can be worse than thought earlier. India’s GDP growth and corporate earnings in FY26 also will be impacted. The market, still trading at elevated valuations, has not discounted such an eventuality. It remains to be seen how things evolve.

India’s response, with facts, that “targeting India is unjustified and unreasonable” sends a message that India will not be making undue concessions and compromises. This means, the market is in uncharted territory in the near-term. If Trump raises tariffs on India further the market will react negatively breaking the Nifty support of 24500. Investors may wait and watch for the developments to unfold. Moving some money to fixed income also can be thought of,” investment strategist Dr VK Vijayakumar, said.