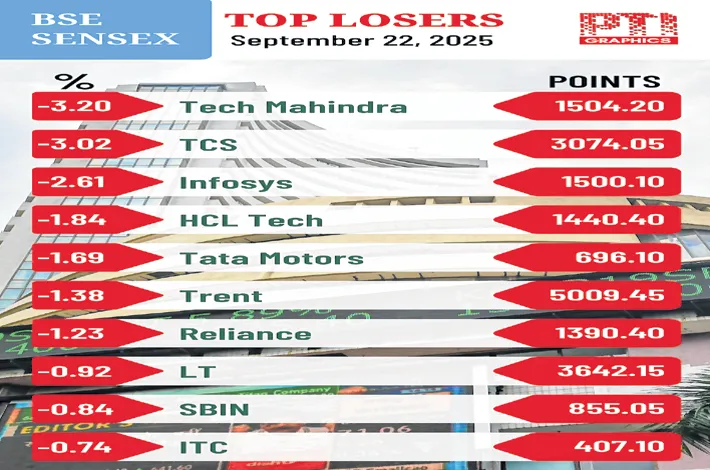

Mkts plummet as H-1B visa fee shock hits IT stocks

23-09-2025 12:00:00 AM

Benchmark equity indices Sensex and Nifty ended sharply lower on Monday, dragged by IT stocks amid concerns over the US President Donald Trump's decision to raise H-1B visa fees to USD 1,00,000 per worker.

Also, selling in blue-chip Reliance Industries took the markets down.

Falling for the second day in a row, the 30-share BSE Sensex dropped 466.26 points or 0.56 per cent to settle at 82,159.97.

The 50-share NSE Nifty declined 124.70 points or 0.49 per cent to 25,202.35.

From the Sensex firms, Tech Mahindra, TCS, Infosys, HCL Tech, Tata Motors, Trent, Reliance Industries and Larsen & Toubro were among the major laggards.

"The domestic market traded on a lower note amid a sharp increase in H-1B visa costs, which weighed on the IT index, while mid and smallcap stocks saw profit-booking following recent gains. GST rationalisation, a normal monsoon, lower interest rates, and tax incentives are expected to support consumption, narrowing the gap between valuations and growth prospects. "Foreign investors are gradually turning buyers, driven by expectations of earnings upgrades in H2FY25, with consumption-focused sectors likely to attract attention and support the market," Vinod Nair, Head of Research, Geojit Investments Limited, said.

Adani Group stocks surge

Adani Group companies continued to rally on Monday, adding Rs 1.78 lakh crore in market valuation in two days, propelled by heavy buying in listed stocks following Sebi's clean chit in the Hindenburg case. Shares of Adani Power jumped 19.99% to hit its upper circuit limit of Rs 170.15 apiece on the BSE. The stock of Adani Total Gas skyrocketed 19.87%, Adani Green Energy zoomed 11.75%, Adani Energy Solutions surged 6.94%, Adani Enterprises Ltd climbed 4.24%, Ambuja Cements rallied 1.43%, Adani Ports went up by 1.17%, NDTV edged higher by 1.12% and ACC (0.30%).