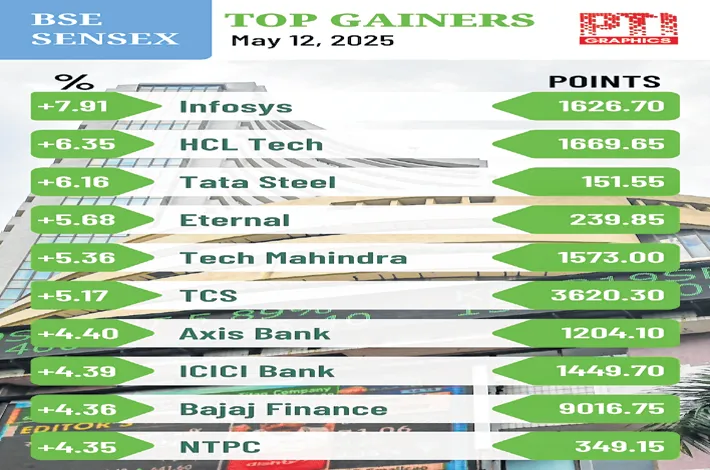

Mkts rally as geo pol stress thaw; best day in four years

13-05-2025 12:00:00 AM

POINTS TO PONDER

- Sensex skyrockets 2,975 pts; Nifty climbs 916 pts

- Suspension of military action boosts sentiment

- Yes Bank shares climb over 2%

- Reliance Power shares zoom 11%

- Favourable macros respond effectively to unprecedented shocks

- China wins a 90-day trade truce

- FPJ News Service mumbai

Indian markets surged across the board on Monday, and key indices, Sensex and Nifty registered their biggest single-day gain in four years. Easing of India-Pakistan border tensions boosted the overall market sentiment. The 30-share BSE Sensex skyrocketed 3.7% (2,975.43 points) to settle at 82,429.90, and NSE Nifty rose 3.8% (916.7 points points) to close at 24,924.70. The rally pushed the benchmark indices to their highest closing levels of 2025, taking them to a seven-month high. IT, metal, realty and tech shares led the rally.

“Confluence of positive geopolitical and economic developments—the ceasefire between India and Pakistan, coupled with a breakthrough trade agreement between the US and China—sparked the strongest daily market rally in recent times. Tariff issues had the pivotal role in the market's consolidation over the year. Sudden easing of the US-China tariff war unlocked multiple investment avenues for investors.

“Sustained FII inflows, along with a resurgence in retail participation fuelled by expectations of a swift improvement in business sentiment, propelled today's upside. However, while the momentum remains strong, the market may enter a phase of consolidation in the near term as investors await concrete signs of earnings growth. In the meantime, mid and small caps are expected to maintain the optimism in the broad market,” pointed out Vinod Nair, Head of Research at Geojit Investments. India has made major strides in the monetary policy framework, and macroeconomic policies have been effectively responding to unprecedented shocks for a long time.

Investors’ wealth (market capitalization of BSE-listed firms) soared by Rs 16.15 lakh crore on Monday to Rs 432 lakh crore (nearly $5.05 trillion). FIIs bought equities worth Rs 1,246.48 crore, and domestic investors bought equities worth Rs 1,448.37 crore.

“Having crossed the previous swing high of around 24,857, the index is now poised to inch towards the 25,200 level, while the 24,400–24,600 zone is expected to offer strong support on any dip,” Ajit Mishra–SVP, Research at Religare Broking, said. Defence-related stocks performed well in line with a sharp rally in the equity market.