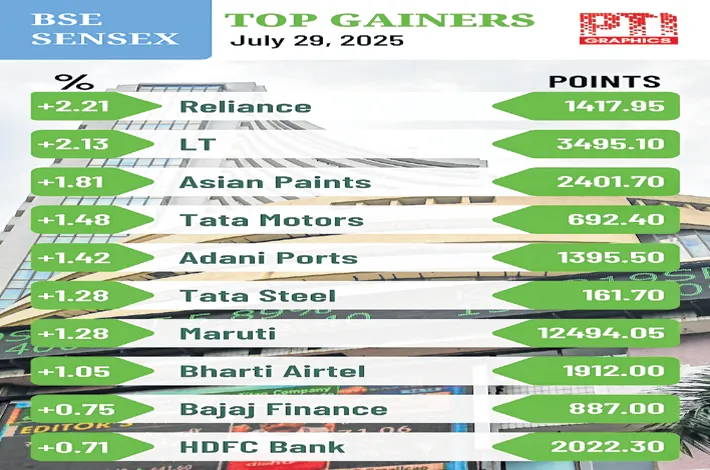

Mkts recover amid Trump’s tariff tactics

30-07-2025 12:00:00 AM

FPJ News Service New Delhi

Markets staged a modest recovery on Tuesday despite US President Trump’s tough tariff tactics continuing to muddle investor sentiment. The 30-share BSE Sensex climbed 446.93 points to settle at 81,337.95. During the day, it surged 538.86 points to 81,429.88. The 50-share NSE Nifty closed 140.20 points higher at 24,821.10. In two days (Jul 28 and 29), FIIs offloaded securities worth Rs 10,719 crore.

Mandar Bhojane, senior technical and derivative analyst (research) at Choice Equity Broking said, “Markets recovering from early losses, driven by selective buying in large-cap stocks. Broader market sentiment improved in the latter half of the session, with advancing stocks outpacing decliners. Among sectoral performers, FMCG, Auto, and Energy showed strength, whereas IT and Metal stocks remained under pressure. In the derivatives segment, India VIX dropped 4.46%, indicating improved trader confidence.”

“Amidst lingering uncertainties over the ongoing US–India trade negotiations, the domestic equity market staged a modest recovery from intraday lows. Almost all the sectors ended in green, with metal, pharma, and realty leading the gains, while IT, financials, and FMCG lagged due to weak quarterly results. Investor sentiment remains cautious ahead of key global events, including policy decisions from the US Fed and the August 1 reciprocal tariff deadline.

Sustenance of this rally is likely to be positive in the near term with an eye on the above details, including Q1 results and this week’s monthly expiry. For the Nifty50 index, 25,000 to 25,100 is likely to act as a restriction at the upper end,” said Vinod Nair, head of research, Geojit Investments.

“A major issue weighing on markets is that the expected trade deal between India and the US hasn’t happened so far, and the probability of a deal before the August 1 deadline is becoming lower. Trump’s success in reaching deals with Japan and EU, which were advantageous for the US, may further make the US position harder on deals with India. Trump, having tasted blood in deals so far, is likely to act tough, going forward,” said Dr VK Vijayakumar, chief investment strategist, Geojit Investments.