Mkts recover, GST reforms in focus

04-09-2025 12:00:00 AM

FPJ News Services mumbai

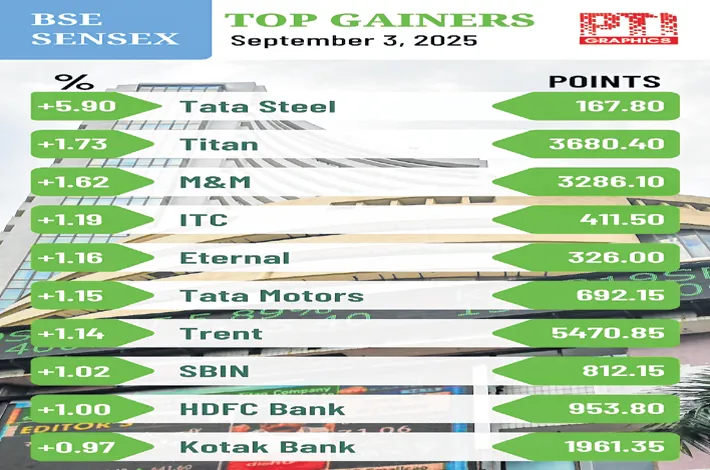

Indian markets closed higher in a volatile session on Wednesday, principally driven by a rally in metal stocks, and a renewed wave of optimism on the GST Council meeting. After fluctuating between highs and lows, the 30-share BSE Sensex climbed 409.83 points to settle at 80,567.71. During the day, it hit a high of 80,671.28 and a low of 80,004.60, gyrating 666.68 points. The 50-share NSE Nifty climbed 135.45 points or 0.55 per cent to 24,715.05.

“Indian equities closed higher after a mixed start to the session, buoyed by expectations of a consumption-led stimulus from the potential GST slab rationalization. All categories of consumer-based sectors, like discretionary, durable and staples, continued to outperform. Meanwhile, gold extended its rally in the global market to fresh highs, reflecting investor caution amid persistent concerns over prolonged US tariffs and their potential impact on global growth and geopolitical changes.

“In the near term, market sentiment hinges on the outcome of the GST Council meeting with traction on consumption-oriented stocks and sectors. Well, the expectations are very high, increasing the risk of disappointments, which can kickstart consolidation again,” said Vinod Nair, head of research, Geojit Investments.

According to Dr VK Vijayakumar, a veteran investment strategist, with global uncertainty on the rise, the market also is going to experience high volatility. There are potentially positive and negative news that can impact the market, going forward. On the negative front, the likelihood of the 25 % penal tariff imposed on India getting withdrawn is getting difficult since India has refused to accept Trump’s dictates.

This means, in the short-run our exports and related jobs will continue to suffer. On the positive front, the Q1 GDP growth number at 7.8% indicates growth momentum in the economy. This will get accelerated by the expected reforms in GST. The net result of all these can be an upward revision in the earnings growth for FY26 and FY 27. This has the potential to turn FIIs into buyers in India triggering a rally in the market. This is a likely scenario which can play out in a few weeks. “The situation may dramatically change if the US Supreme Court disallows the appeal from the US administration regarding Trump’s tariffs, he added.