Pivotal scrips decline on profit-booking

14-05-2025 12:00:00 AM

FPJ News Service mumbai

Indian markets on Tuesday witnessed significant selling pressure amid broad-based profit booking, particularly in IT, auto, and FMCG sectors, after the best single day rally on Monday.

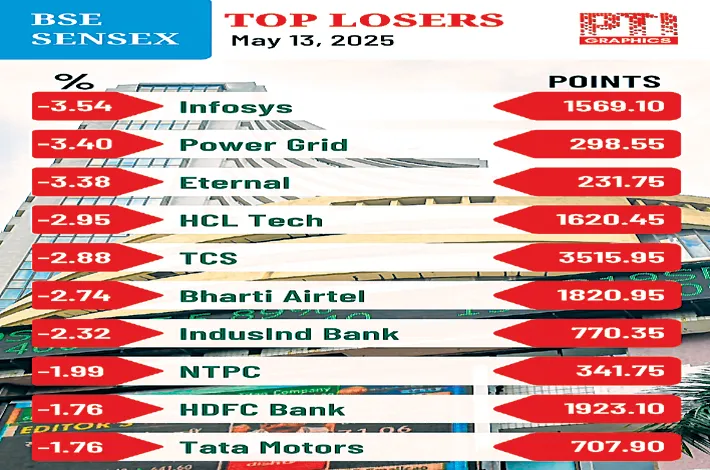

Mirroring the trend, the 30-share BSE Sensex nosedived 1,281.68 points (1.55%) to close at 81,148.22 with 25 of its constituents closing with losses and five with gains. During the day, the benchmark index declined sharply by 1,386.21 points (1.68%) to 81,043.69. The broader Nifty of NSE dropped 346.35 points (1.39%) to 24,578.35.

According to Bajaj Broking Research, defence-related counters saw strong accumulation, buoyed by renewed market enthusiasm around the indigenisation of defence manufacturing and equipment. Interestingly, despite the weakness in frontline indices, the broader market outperformed. The Nifty midcap and smallcap indices closed in positive territory, advancing 0.21% and 0.81% respectively, reflecting continued investor interest in mid- and small-cap segments.

Sectorally, the Nifty IT index emerged as the biggest laggard, plunging nearly 2.5% in intraday trade. Auto and FMCG counters also faced considerable headwinds, contributing to the overall bearish sentiment. In contrast, pharmaceutical stocks outperformed, defying the broader downtrend. Defence-related counters saw strong accumulation, buoyed by renewed market enthusiasm around the indigenisation of defence manufacturing and equipment.

“This consolidation is primarily affecting large-cap stocks, while mid- and small-cap segments continue to gain traction. This divergence is expected to persist, supported by broad-based earnings improvements reflected in Q4 results so far. The market is optimistic about FY26 earnings, underpinned by supportive fiscal and monetary policies, and a declining inflation rates,” said Vinod Nair, Head of Research, Geojit Investments.