Pivotals rally, sentiment remains optimistic

12-08-2025 12:00:00 AM

FPJ News Service mumbai

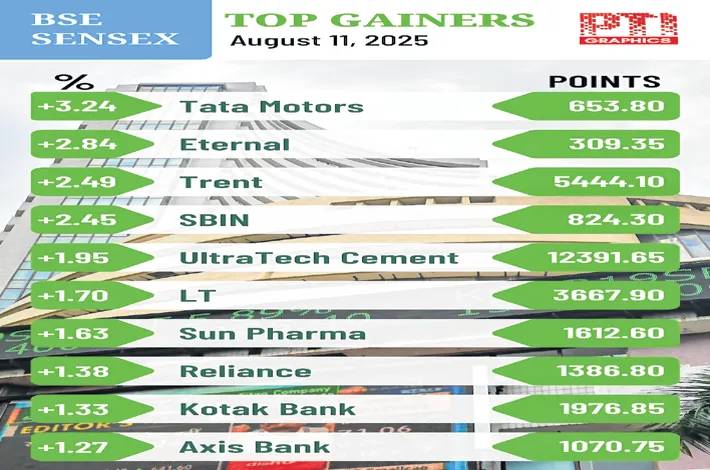

Indian markets witnessed a “relief rally” on Monday amid fresh fund inflows from domestic institutional investors. Investors are positively assessing the upcoming US-Russia Summit, which may possibly give way to a de-escalation in tensions. The 30-share Sensex climbed 746.29 points to settle at 80,604.08 with 26 of its constituents closing higher. During the day, it surged 778.26 points to 80,636.05. The 50-share NSE Nifty jumped by 221.75 points to 24,585.05.

“The market will be focused on the outcome of the Trump-Putin talks in Alaska. If the talks put an end to the Russia-Ukraine war, that would be a major positive development. US sanctions on Russia may be withdrawn and consequently the penal tariff of 25% imposed on India for buying oil from Russia also may be reconsidered. If this happens the oversold market will stage a smart rebound,” said Dr VK Vijayakumar, chief investment strategist at Geojit Investments.

“Investors will have to wait and watch for the developments. India has been underperforming other markets significantly in the last six weeks. Nifty is down 7.6% from the September 2024 record high. Even though a sharp short-covering rally may happen on positive news, a sustained rally will happen with only fundamental support on the earnings front. This can happen from Q3 onwards. Now, safety is in fairly-valued large-caps,” he said.

Shares of SBI climbed over 2%. The stock went up by 2.45% to Rs 824.30 apiece on the BSE. During the day, it rallied 2.53% to Rs 824.95. On the NSE, it edged higher by 2.38% to Rs 823.45. Shares of Voltas lost 9% after the firm reported a decline of 58% in consolidated net profit for the June quarter. The stock fell 7.78% to Rs 1,202.20 on the BSE, and at the NSE, it dropped 8.65% to Rs 1,192.

“The market saw a “relief rally” post a 3-month low; a positive global cue and a gradual return of FIIs supported the sentiment. The PSU banks were in the limelight amidst Q1 results from the banking major, while a broad-based momentum was visible across all sectors,” said Vinod Nair, head of research at Geojit.