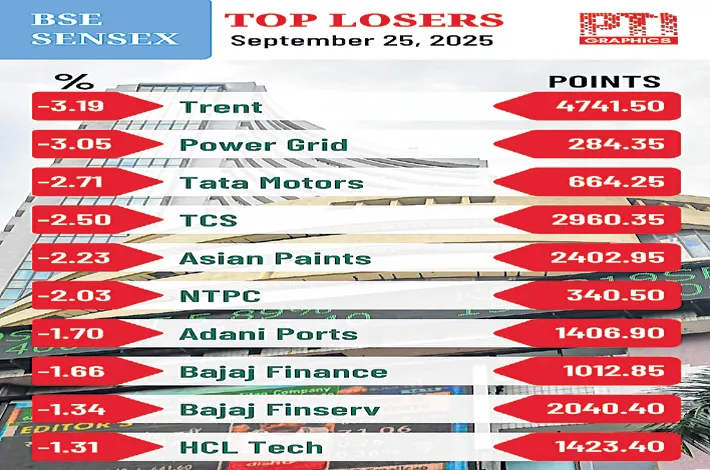

Profit-booking continues amid uncertainty over India-US talks

26-09-2025 12:00:00 AM

FPJ News Service mumbai

Domestic markets extended its losing streak for a fifth straight session on Thursday as investors booked profits amid persistent FII fund outflows and uncertainty over India-US BTA talks. The 30-share BSE Sensex lost 555.95 points to settle at 81,159.68. During the day, it declined 622.74 points to 81,092.89. The 50-share NSE Nifty tumbled 166.05 points to 24,890.85.

“Broad-based selling prevailed in the market with heavy selling across auto, IT, pharma, and healthcare sectors, while metals gained on the back of China’s liquidity support and copper supply concerns. Overall, sentiment remains cautious ahead of India’s H2FY26 borrowing and US macroeconomic data, expected to be released over the end of the week,” Vinod Nair, head of research at Geojit Investments, said.

“In the absence of immediate triggers, the market has been slowly drifting down. Auto stocks have been bullish, partly discounting the potential earnings growth of the industry. The significant drag on the market throughout this year has been the sustained selling by FIIs. The FII strategy of selling in India and buying in other markets has paid rich dividends as evidenced by the huge underperformance of the Indian market vis-à-vis others. While Nifty is down 3.6 % y/y Hang Seng is up by 38.6 % and Kospi is up by 33.73 %. This huge underperformance and the high valuations in India has emboldened FIIs to continue selling in India,” said Dr VK Vijayakumar, chief investment strategist at Geojit Investments.

IT stocks reel under pressure for 4th day

IT stocks continued to slide for the fourth day in a row as the staggering hike in US H-1B visa fees continues to hurt investor sentiment. Infobeans Technologies lost 2.64%, TCS fell 2.50%, Hexaware Technologies lost 1.91%, HCL Technologies 1.31%, Wipro 1.06%, Infosys (0.64%) and Tech Mahindra (0.61%). The BSE IT index lost 1.10%, and settled at 34,149.55.